How to Register and start Trading with a Demo Account on FxPro

To start your forex trading journey on a solid foundation, you need to use a Demo Account to hone your skills risk-free. FxPro, a reputable forex broker, provides an easy and user-friendly process for registering and starting trading with a Demo Account. This guide is designed to walk you through the steps, ensuring a smooth initiation into the exciting world of forex trading on FxPro.

How to Register a Demo account

How to Register a Demo Account on FxPro [Web]

How to register an account

To register a demo account, you must first register an account on FxPro (this is a mandatory step).

First, visit the FxPro homepage and select "Register" to begin the account registration process.

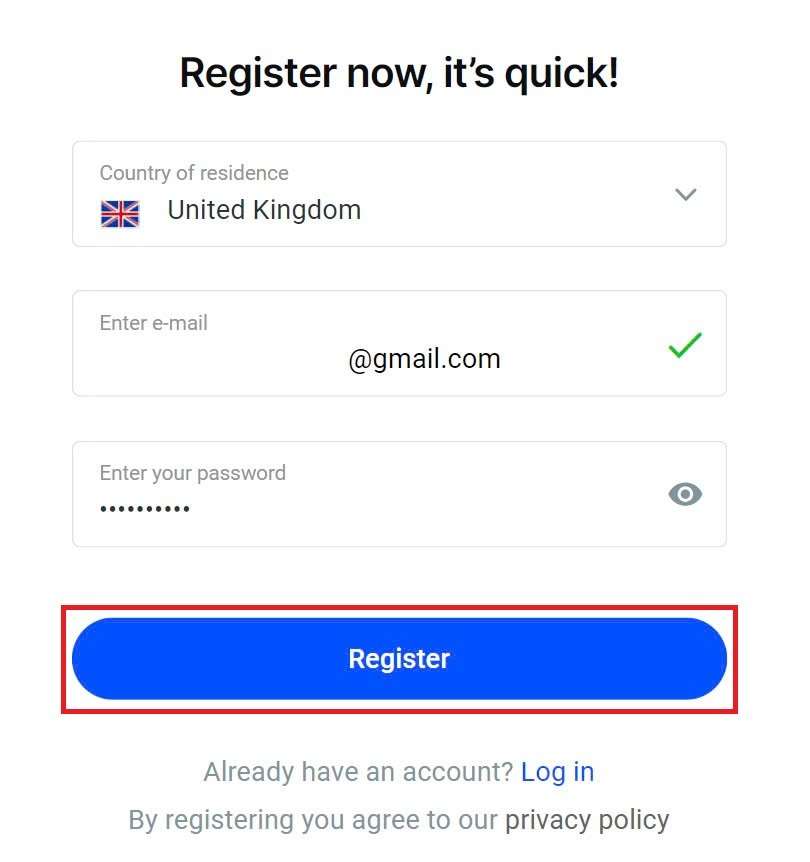

You will immediately be directed to the account registration page. On the first registration page, please provide FxPro with some basic information, including:

-

Country of residence.

-

Email.

-

Your password (Please note that your password must meet certain security requirements, such as having at least 8 characters, including 1 uppercase letter, 1 number, and 1 special character).

After providing all the required information, select "Register" to continue.

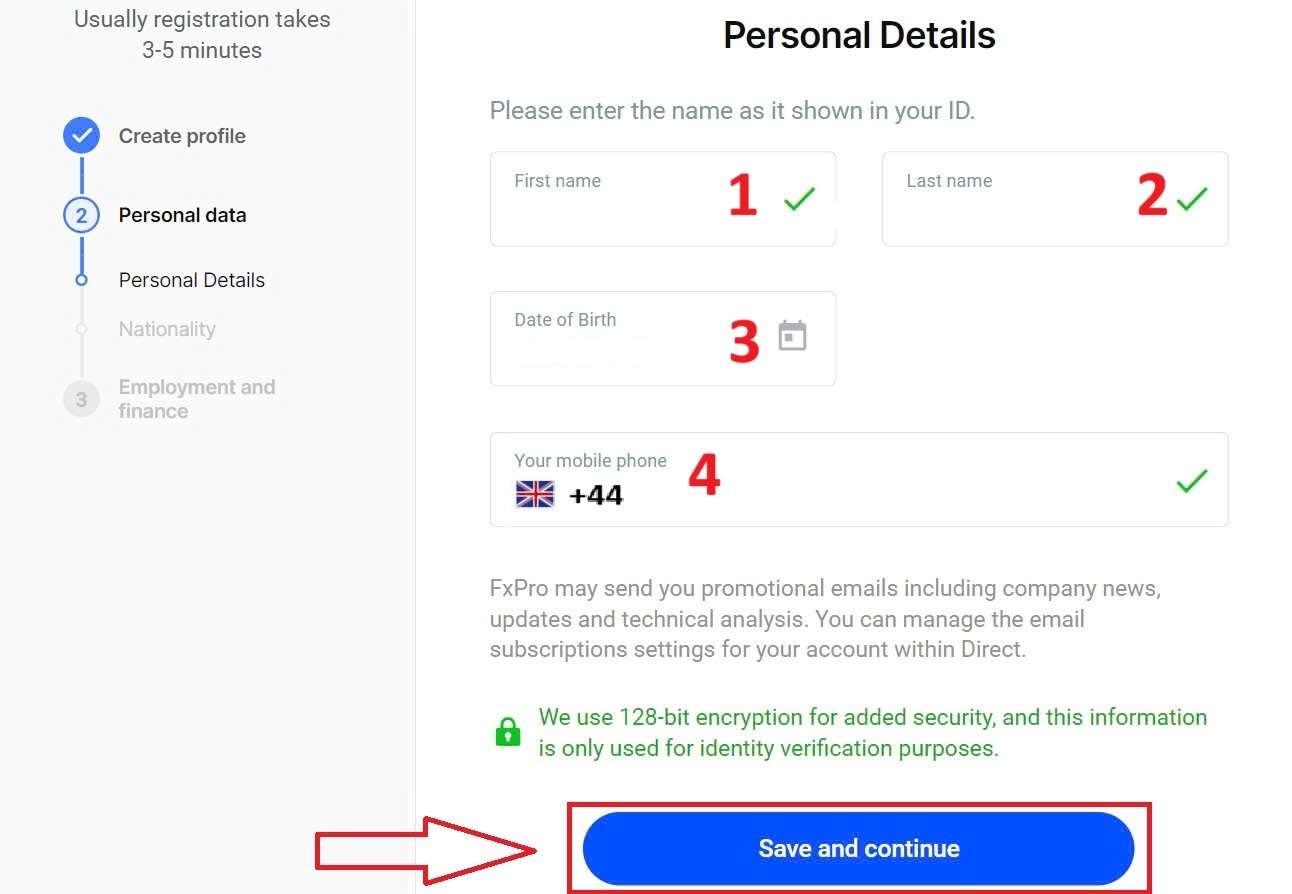

On the next registration page, you will provide information under "Personal Details" with fields such as:

-

First name.

-

Last name.

-

Date of Birth.

-

Your mobile number.

After completing the form, select "Save and continue" to proceed.

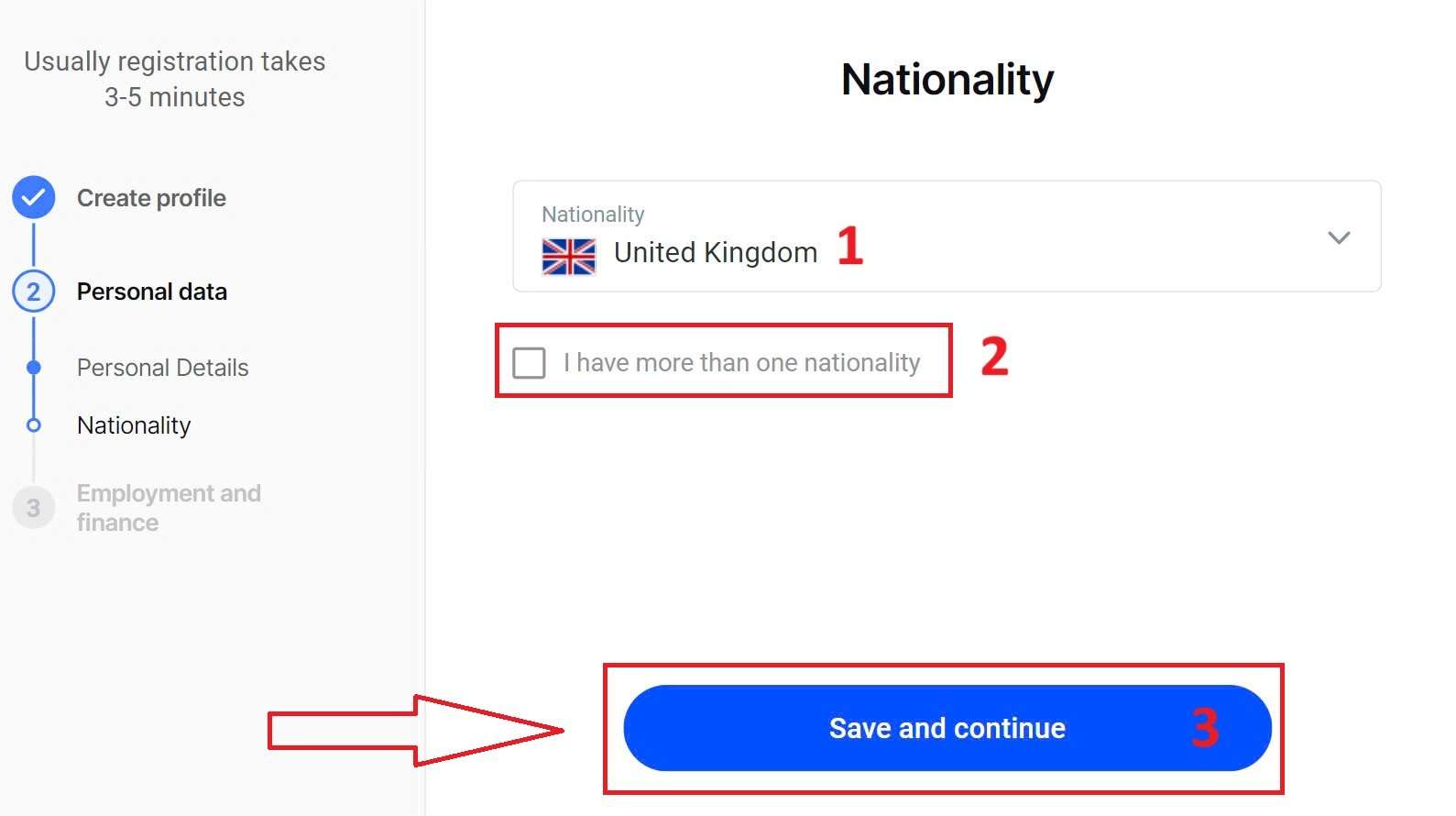

The next step is to specify your nationality under the "Nationality" section. If you have more than one nationality, check the box I have more than one nationality and select the additional nationalities. Then, select "Save and continue" to proceed with the registration process.

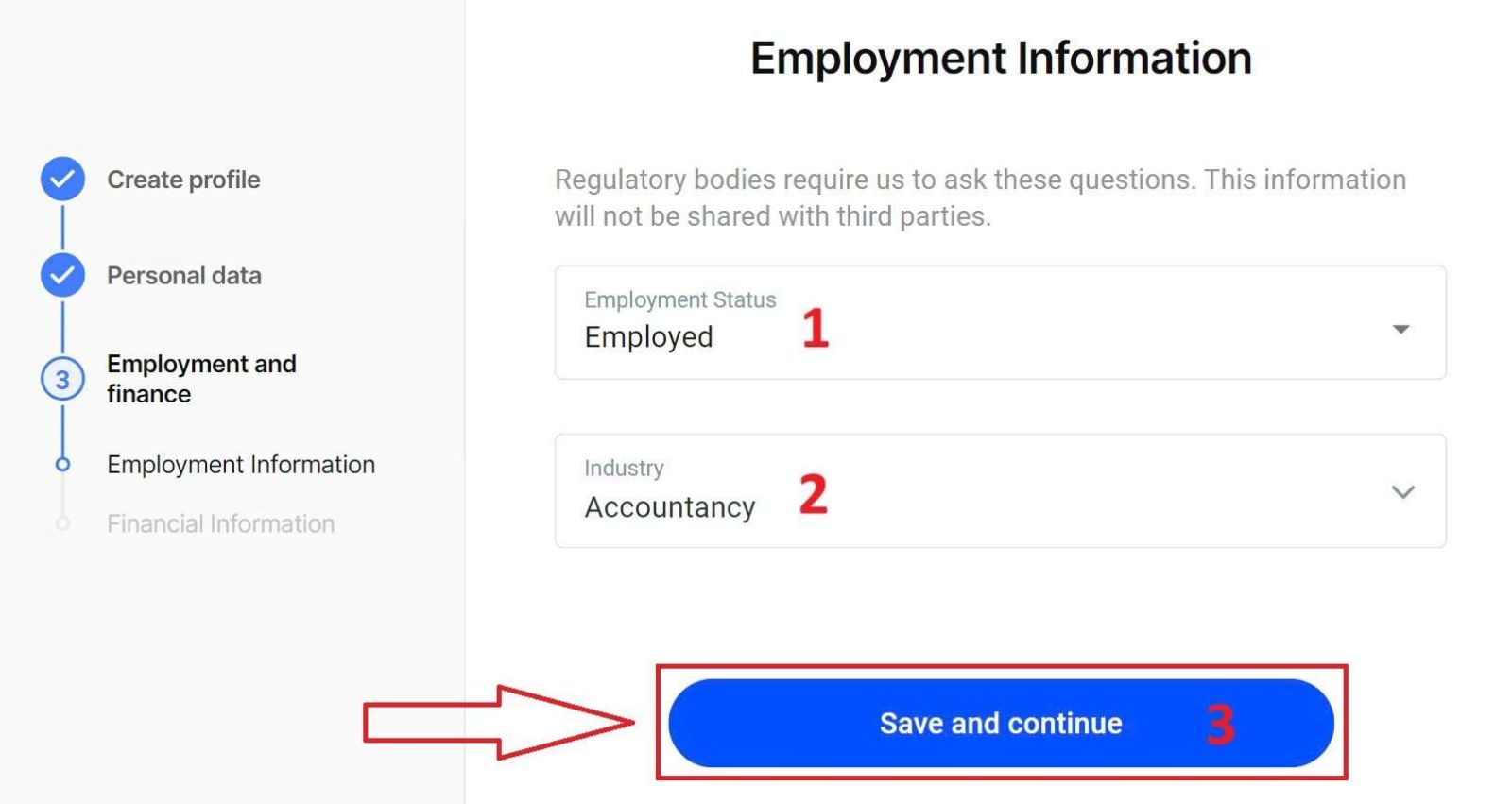

On this page, you must provide FxPro with information about your Employment Status and Industry in the Employment Information Section. Once you finish, click "Save and continue" to move to the next page.

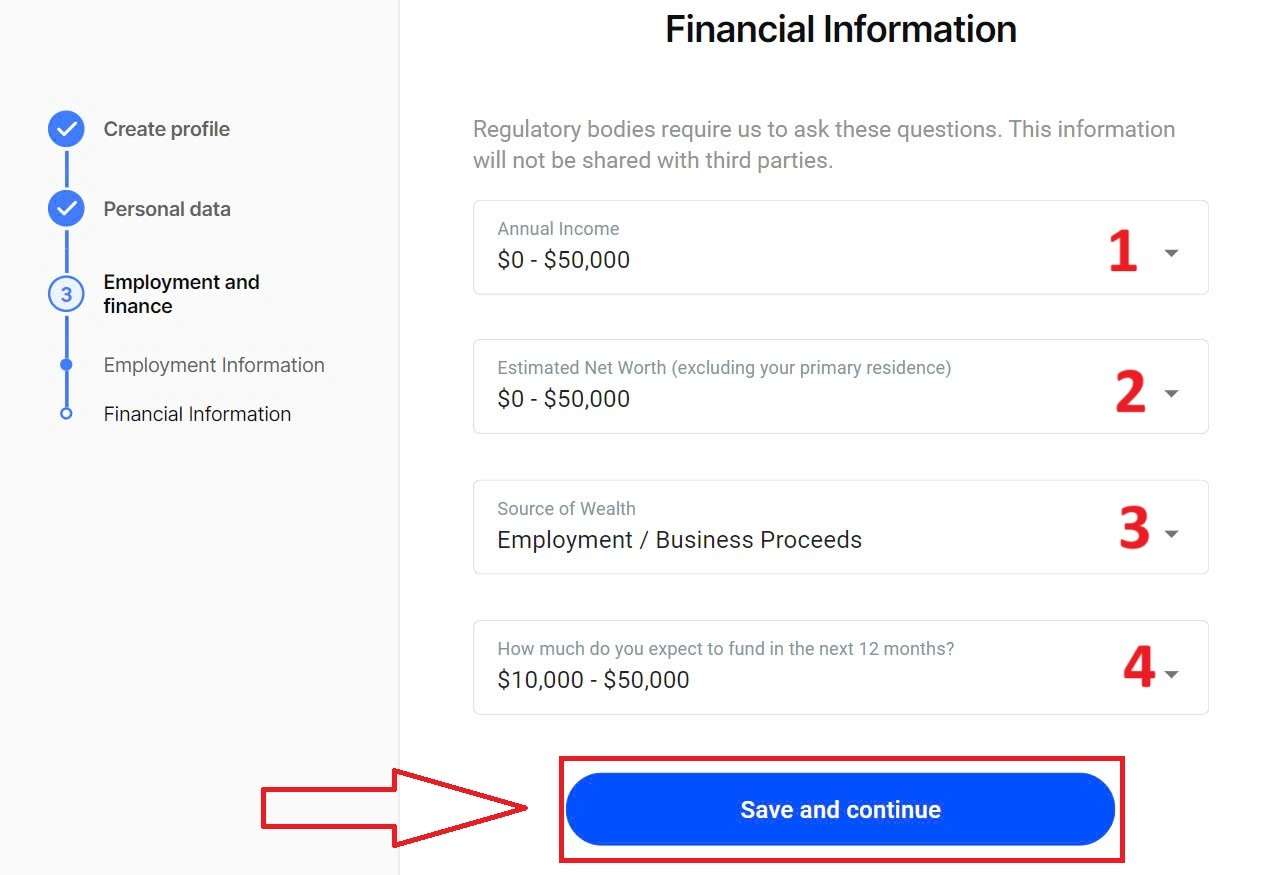

On this page, you will need to provide FxPro with some information about Financial Information such as:

-

Annual Income.

-

Estimated Net Worth (excluding your primary residence).

-

Source of Wealth.

-

How much do you expect to fund in the next 12 months?

After completing the information fields, select "Save and continue" to complete the registration process.

Congratulations on successfully registering an account with FxPro. Don’t hesitate any longer—start trading now!

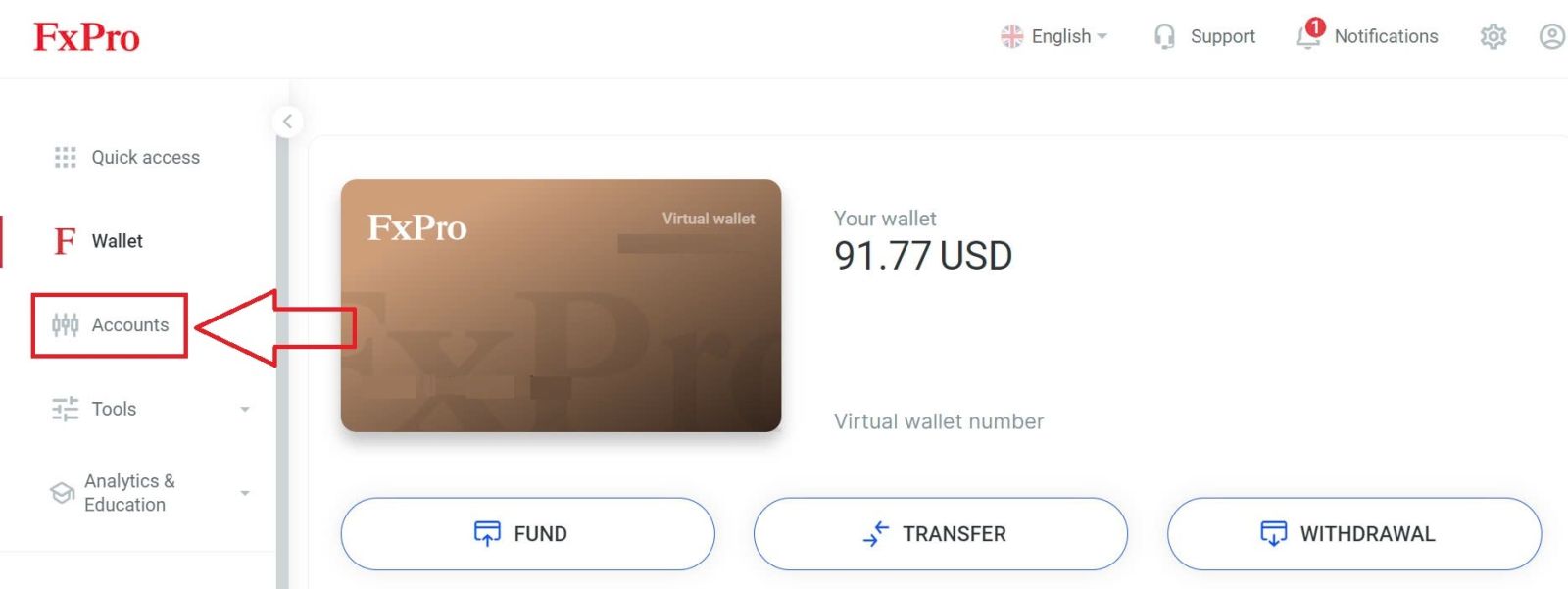

How to create a demo trading account

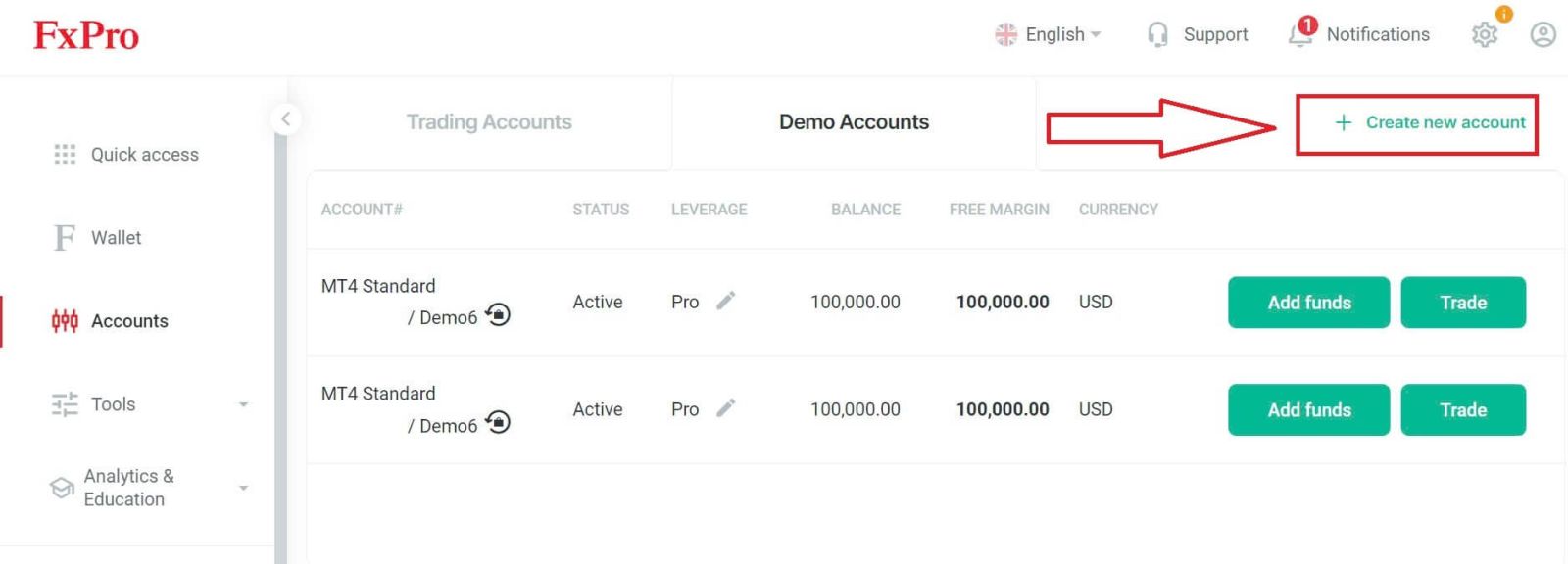

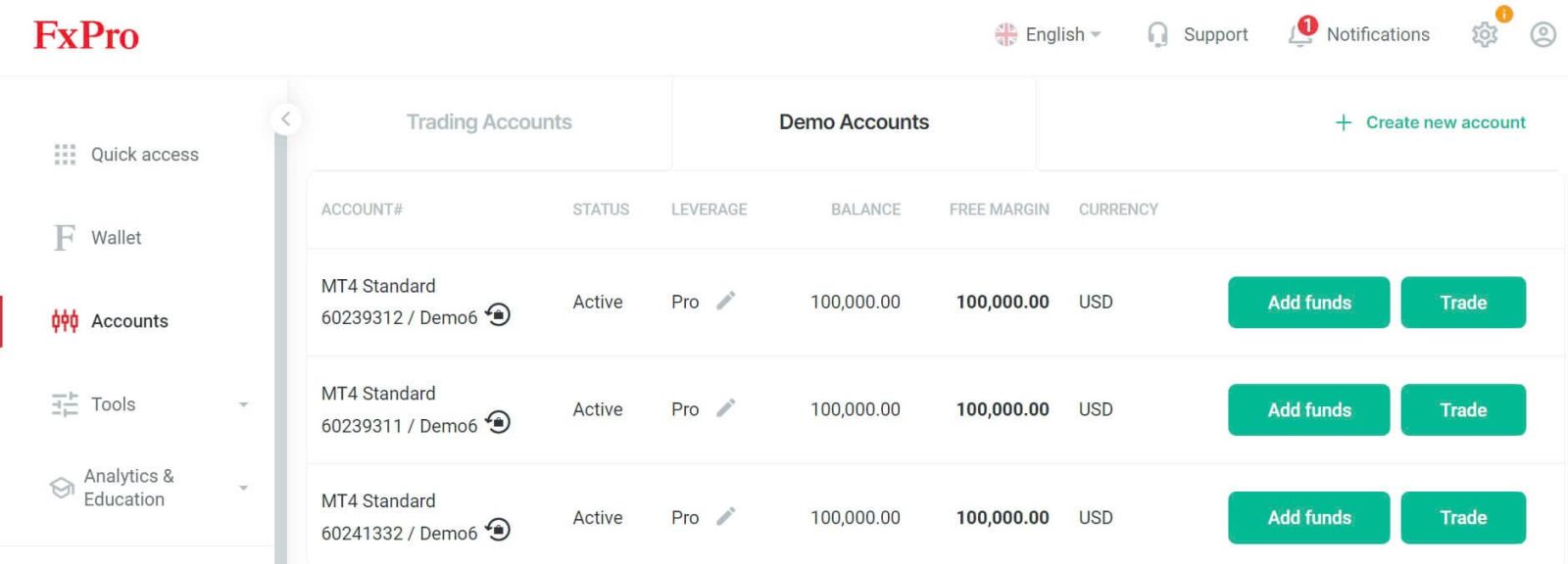

On the main interface after registering with FxPro, select the "Accounts" tab on the vertical menu on the left side of the screen

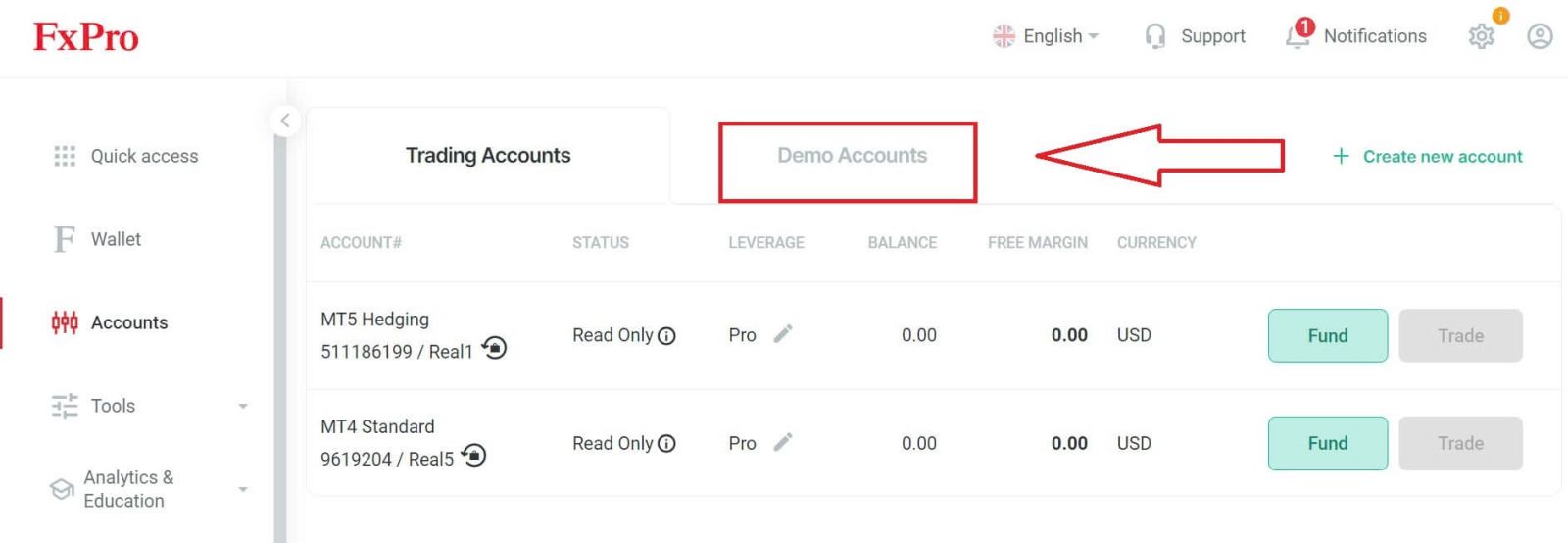

Then, click the "Demo Accounts" option on the small toolbar within the "Accounts" tab (as shown in the descriptive image).

On this page, look at the top right corner of the screen and click the "Create new account" button to be directed to the demo account registration page.

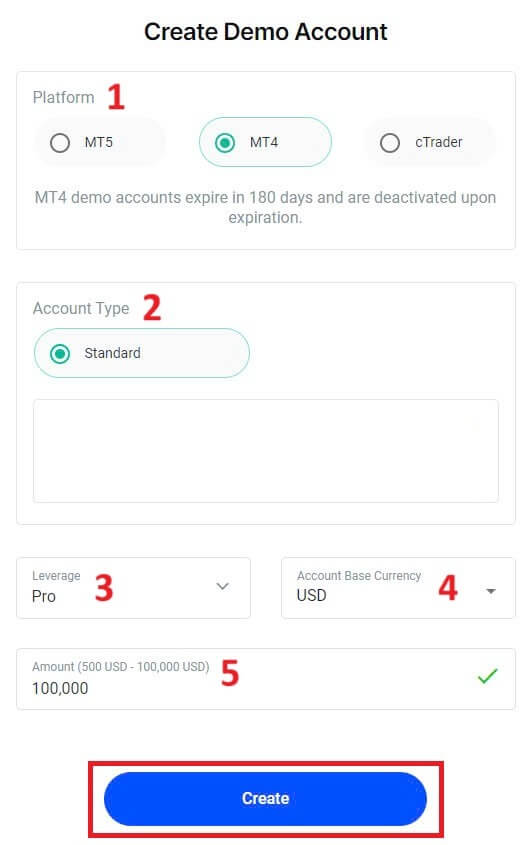

At this moment, a demo account registration form will appear for you to fill in some necessary information, such as:

-

The Platform (MT5/ MT4/ cTrader).

-

Account Type (this may vary depending on the platform you chose in the previous field).

-

The Leverage.

-

The Account Base Currency.

-

The amount of balance you wish (valid from 500 USD to 100.000 USD).

Once you finish, click the "Create" button at the end of the form to complete the process.

Congratulations on successfully registering a demo account with FxPro. Join us to experience the simple yet exciting trading process right away!

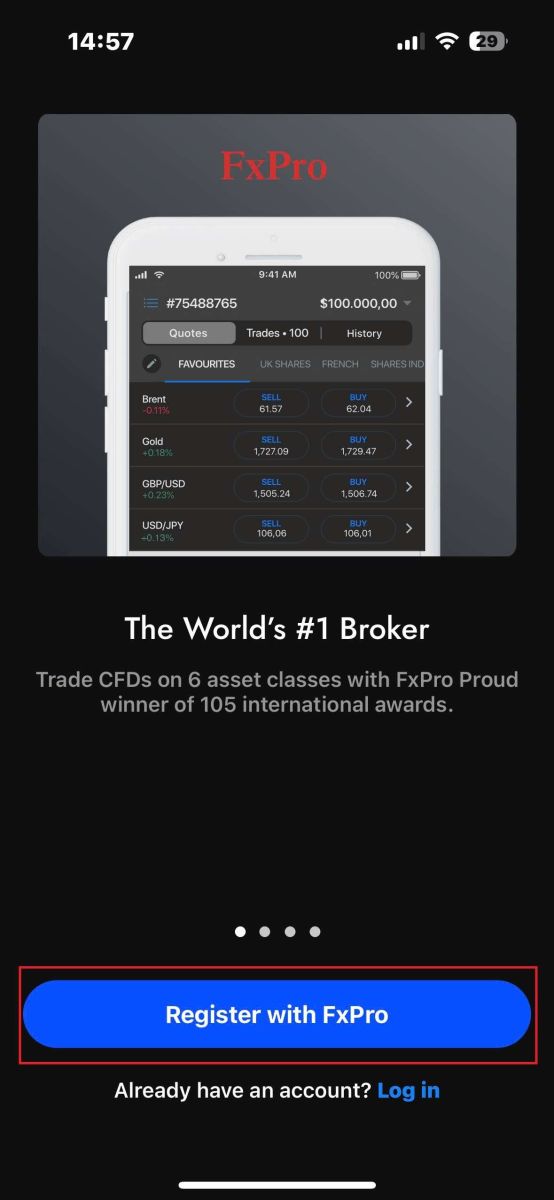

How to Register a Demo Account on FxPro [App]

Set up and register an account

To register a demo account, you must first register an account on FxPro (this is a mandatory step).

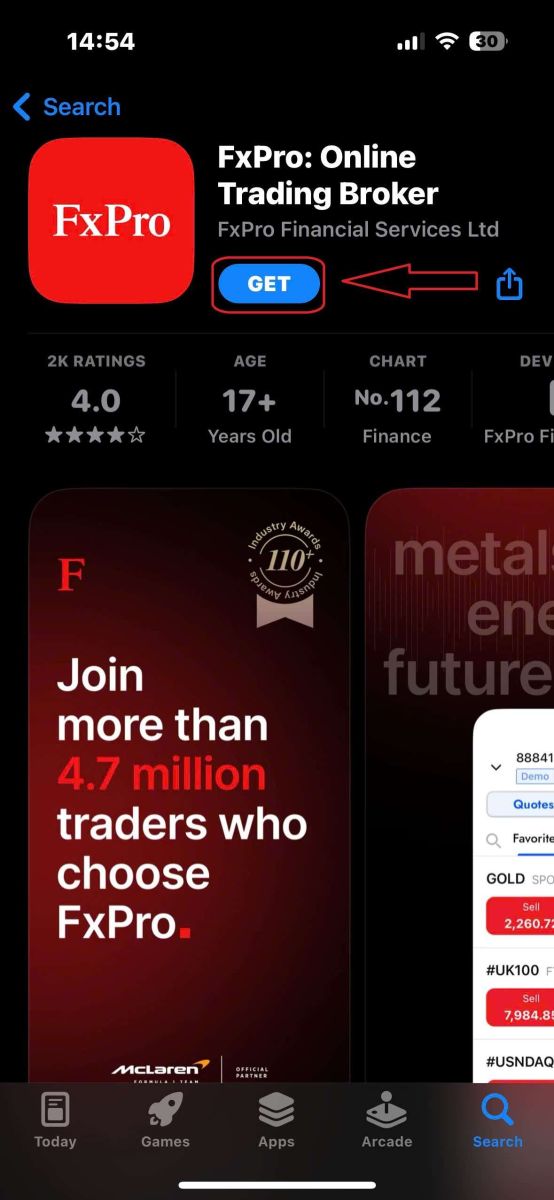

First, open the App Store or Google Play on your mobile device, then search for "FxPro: Online Trading Broker" and download the app.

After installing the app, open it and select "Register with FxPro" to begin the account registration process.

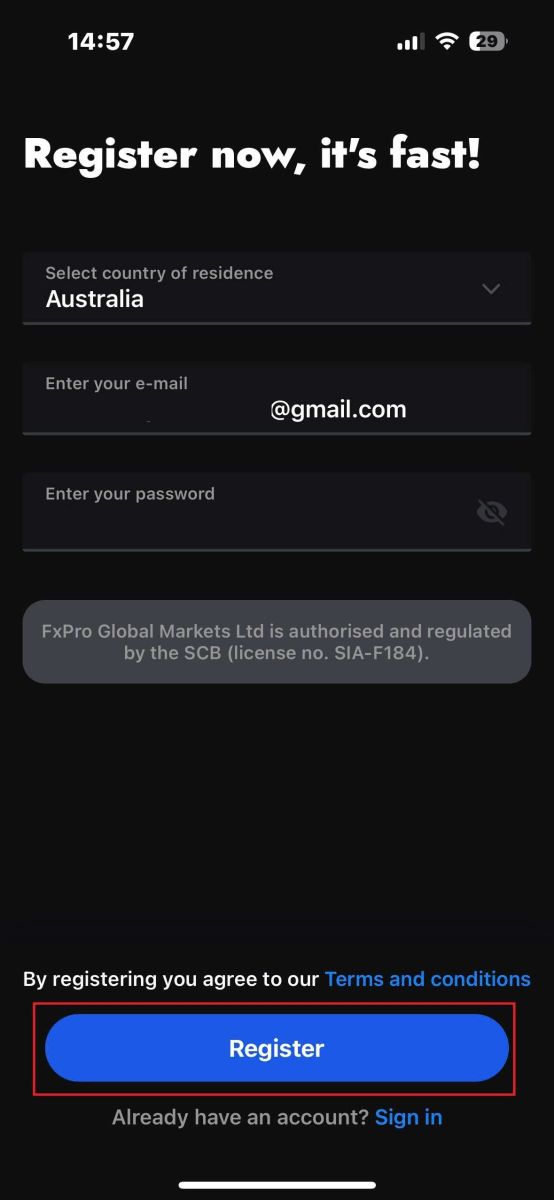

You will be redirected to the account registration page right away. On the initial registration page, you need to provide FxPro with some essential details, including:

-

Your country of residence.

-

Your email address.

-

A password (Make sure your password meets security criteria, such as being at least 8 characters long and including 1 uppercase letter, 1 number, and 1 special character).

Once you have entered all the necessary information, click "Register" to proceed.

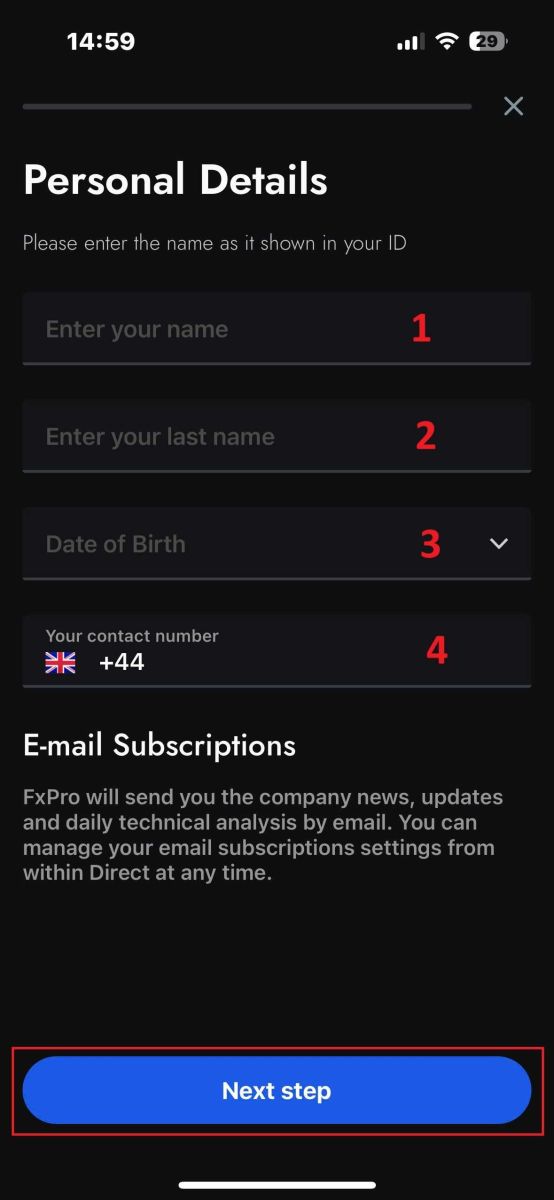

On the subsequent registration page, you will need to fill out the "Personal Details" section, which includes fields for:

-

First name.

-

Last name.

-

Date of Birth.

-

Contact number.

After filling out the form, click "Next step" to move forward.

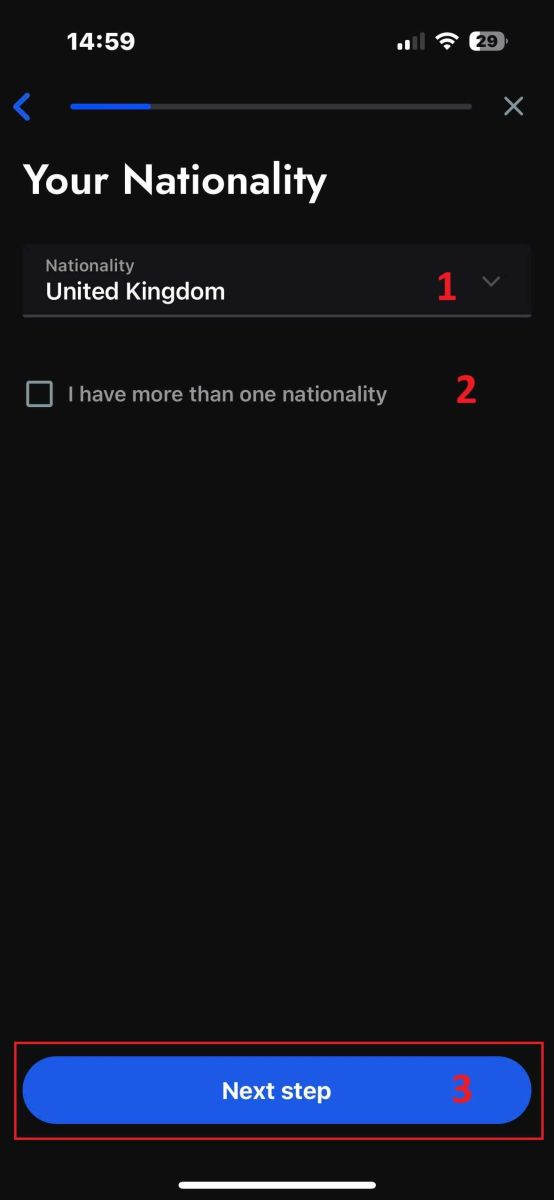

In the following step, indicate your nationality in the "Nationality" section. If you hold multiple nationalities, check the box for "I have more than one nationality" and select the additional nationalities.

Afterward, click "Next step" to advance in the registration process.

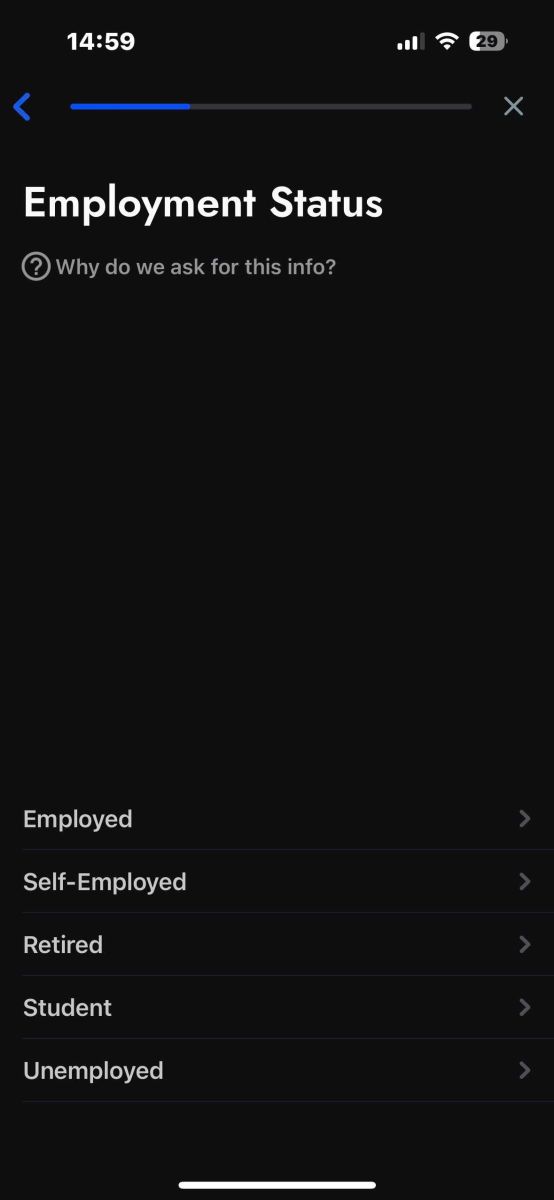

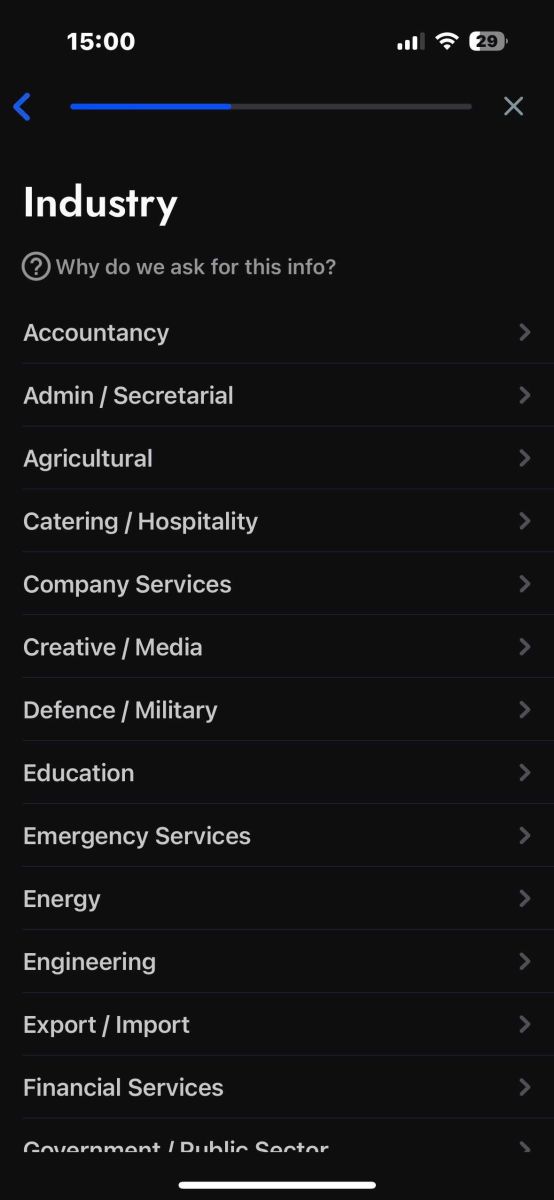

On this page, you need to provide FxPro with details about your Employment Status and Industry.

Once you have completed this, click "Next step" to proceed to the next page.

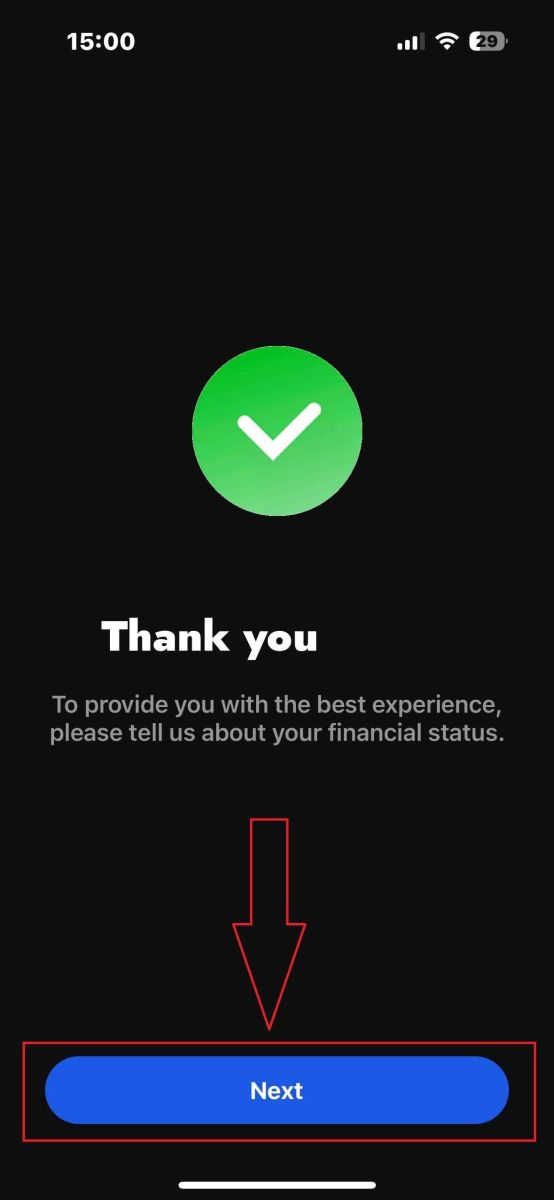

Congratulations on nearly completing the account registration process with FxPro on your mobile device!

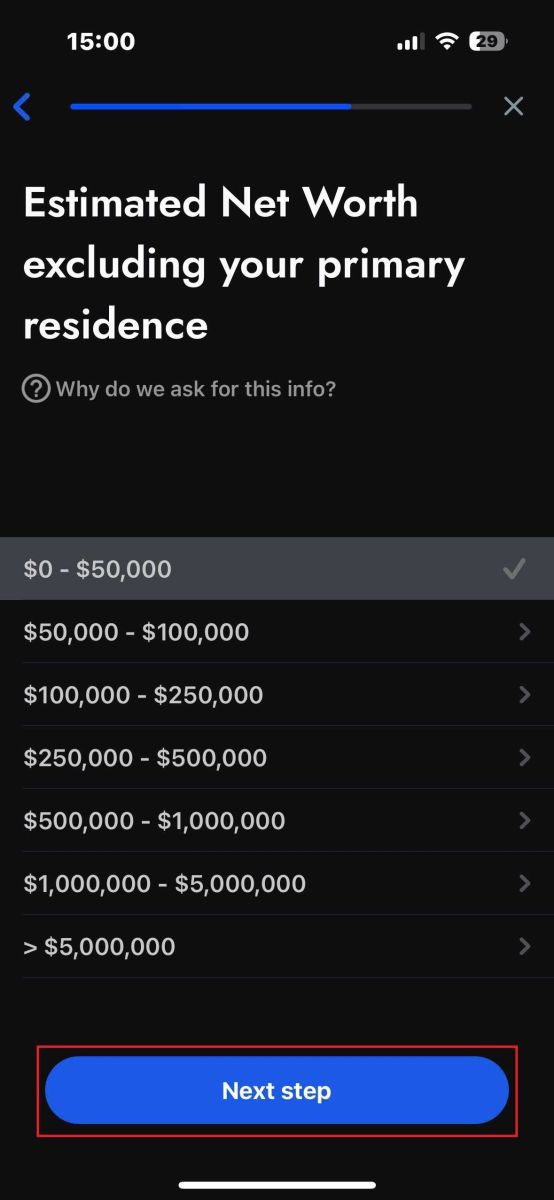

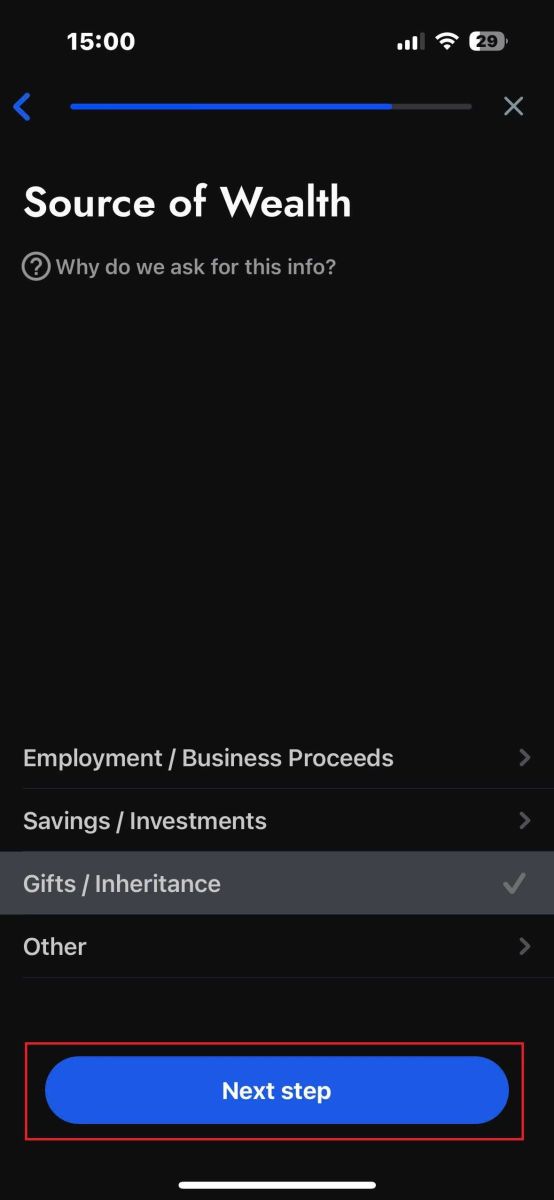

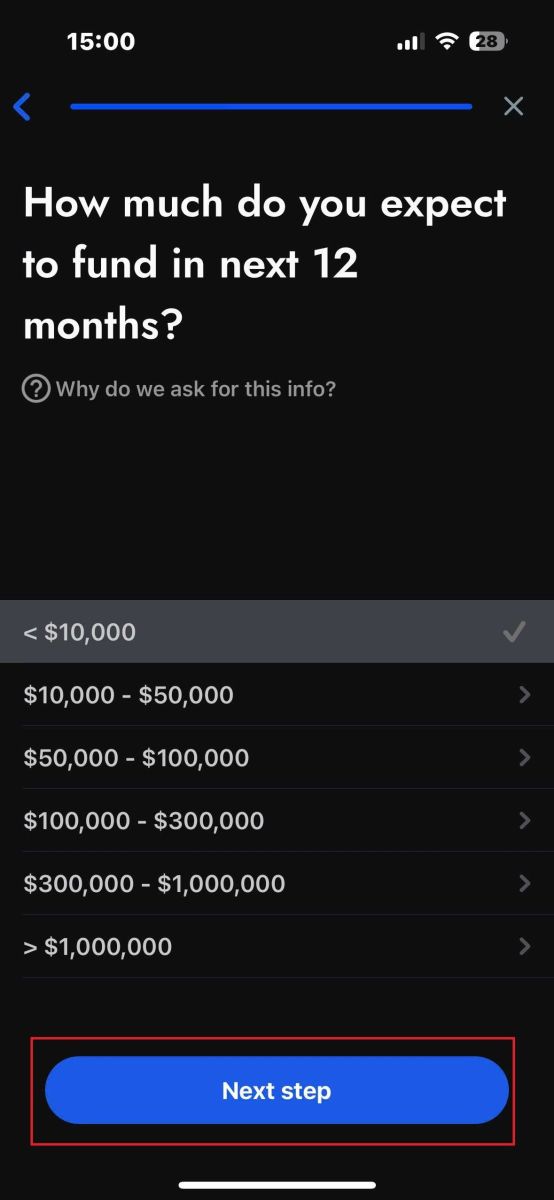

Next, you will need to provide information about your Financial Status. Please tap "Next" to proceed.

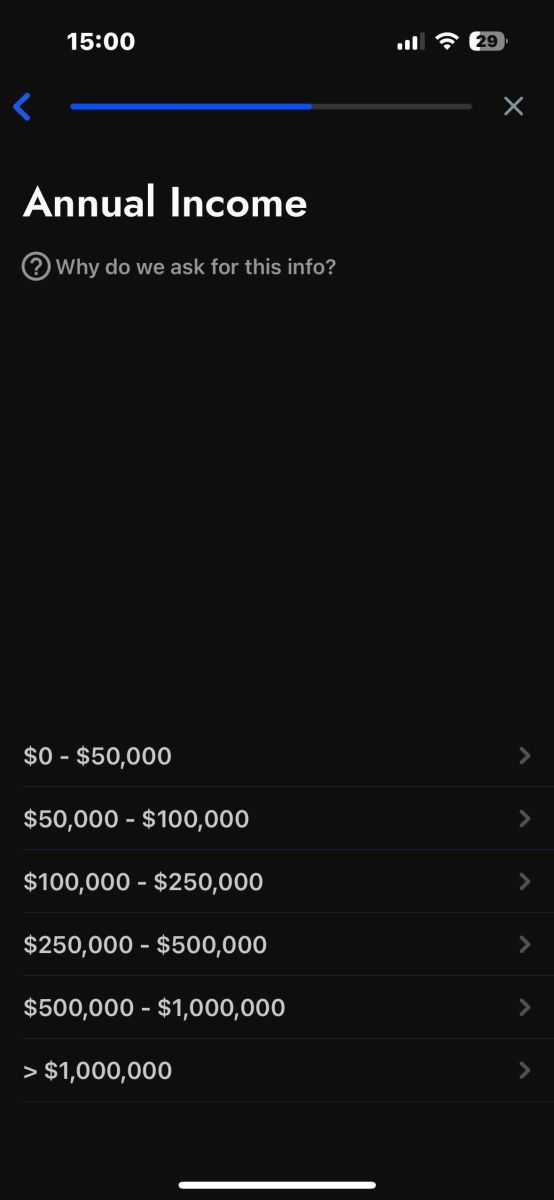

On this page, you’ll need to provide FxPro with details about your Financial Information, including:

-

Annual Income.

-

Estimated Net Worth (excluding your primary residence).

-

Source of Wealth.

-

Expected funding amount for the next 12 months.

Once you’ve filled out the information, click "Next step" to finalize the registration process.

After completing the survey questions in this section, select "Next step" to finish the account registration process.

Congratulations on successfully registering your account! Trading is now easy with FxPro, allowing you to trade anytime, anywhere with your mobile device. Join us now!

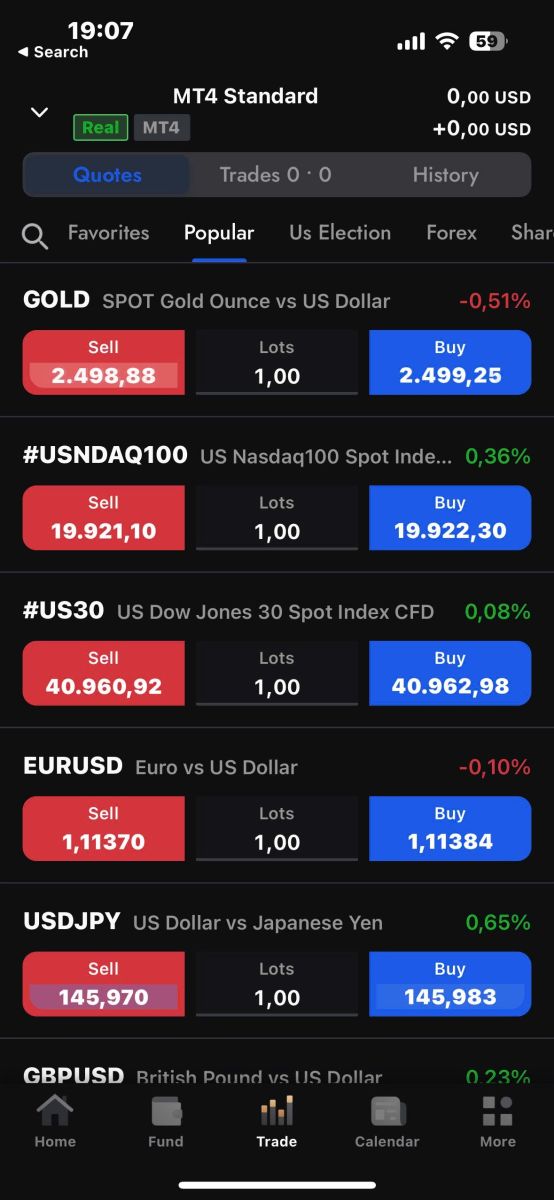

How to create a demo trading account

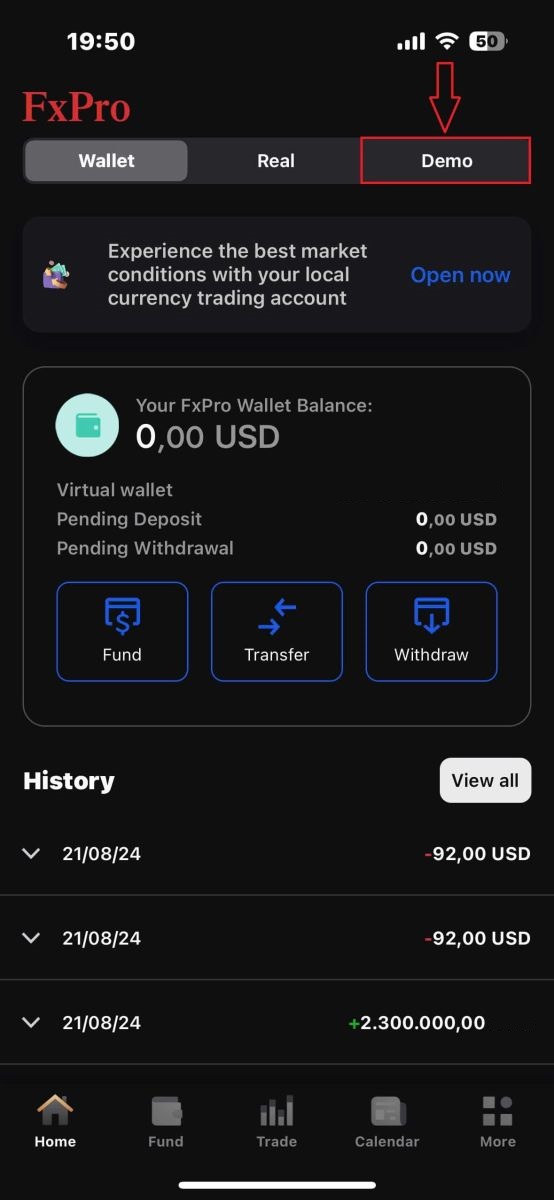

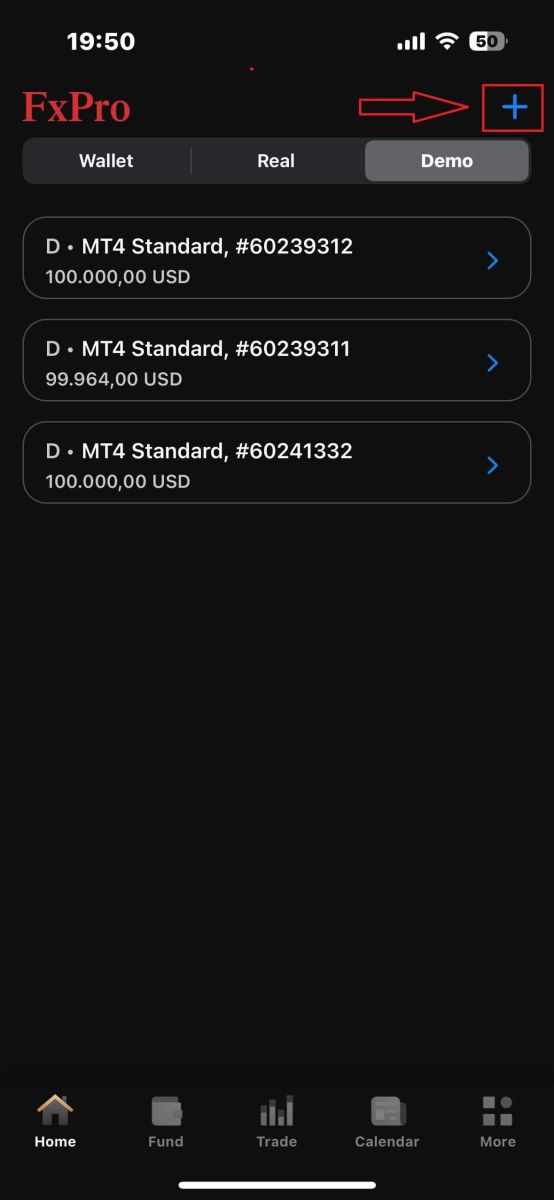

After successfully registering a real account on the FxPro mobile app, on the app’s main interface, select the "DEMO" tab at the top right corner of the screen to get started.

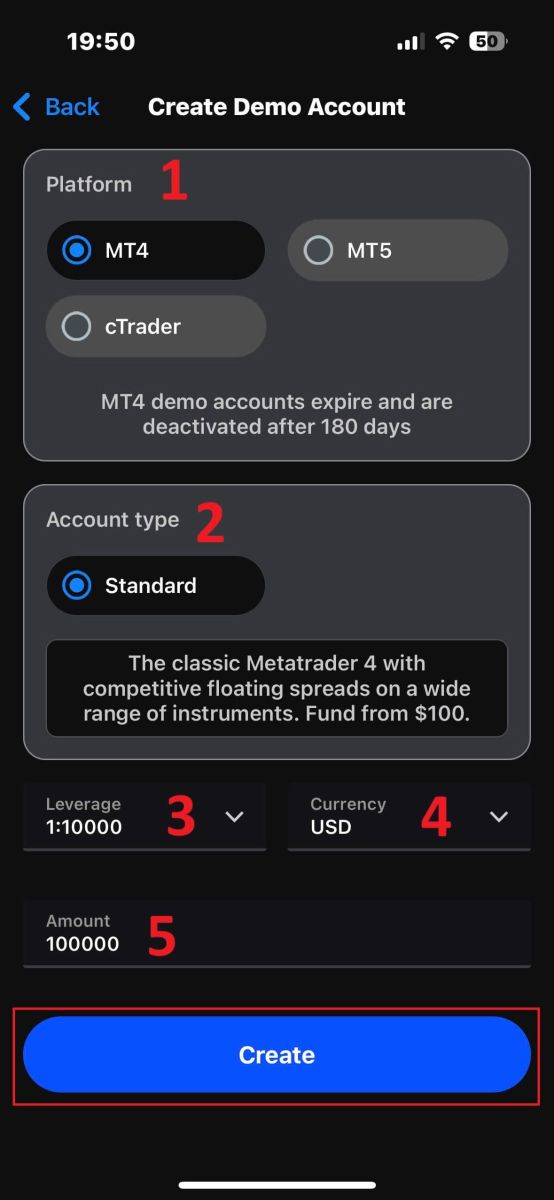

At this point, a demo account registration form will appear for you to enter the following details:

-

The Platform (MT5, MT4, or cTrader).

-

Account Type (which may vary based on the chosen platform).

-

Leverage.

-

Currency.

-

The desired balance amount (between 500 USD and 100,000 USD).

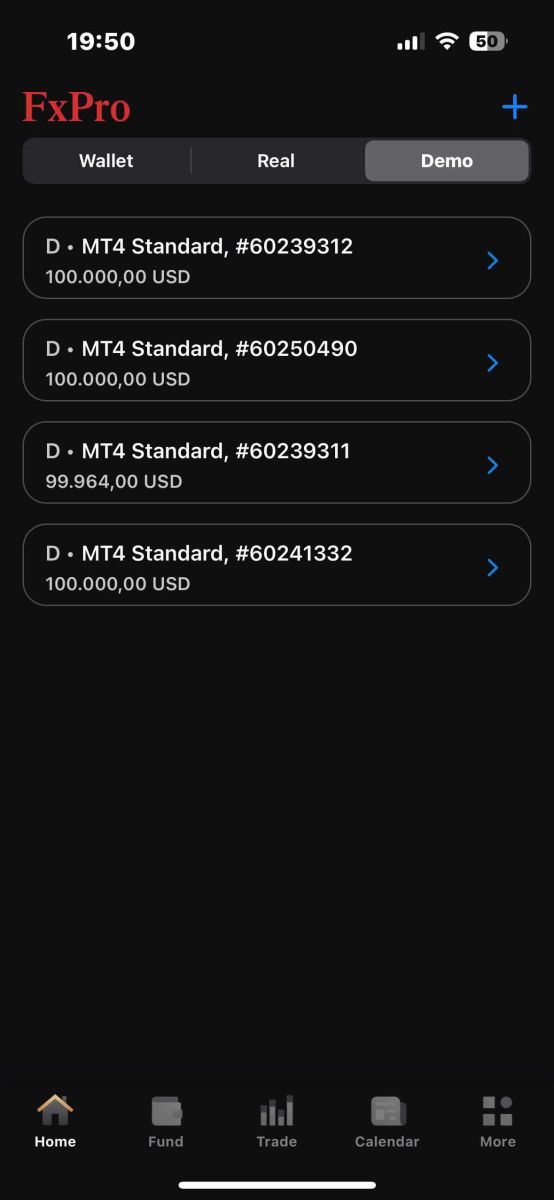

After completing the form, tap the "Create" button at the bottom to finalize the process.

Congratulations on successfully setting up your demo account with FxPro! Start experiencing the straightforward and exciting trading process now!

What is the difference between a Real and a Demo account?

The main distinction is that Real accounts involve trading with actual funds, whereas Demo accounts use virtual money with no real value.

Aside from this, market conditions for Demo accounts are identical to those for Real accounts, making them perfect for practicing strategies.

How to start Trading Forex with FxPro

How to place a New Order on FxPro MT4

Initially, please download and log in to your FxPro MT4. If you don’t know how to do so, please refer to this article with detailed and simple instructions: How to Login to FxPro

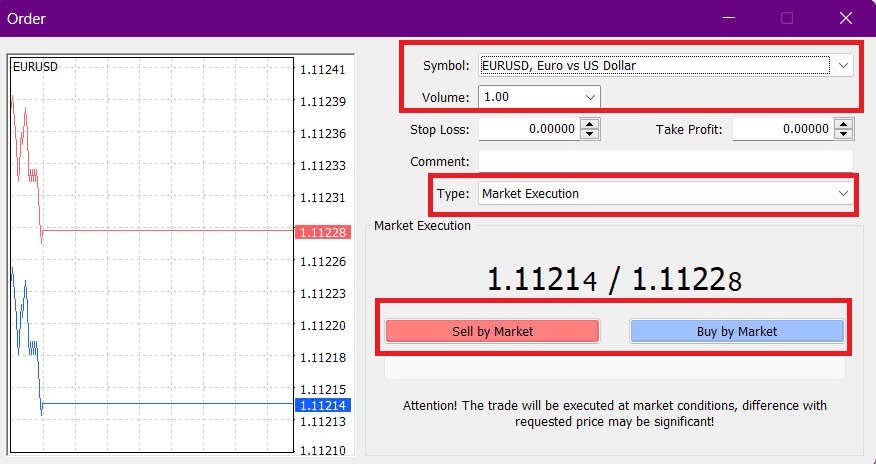

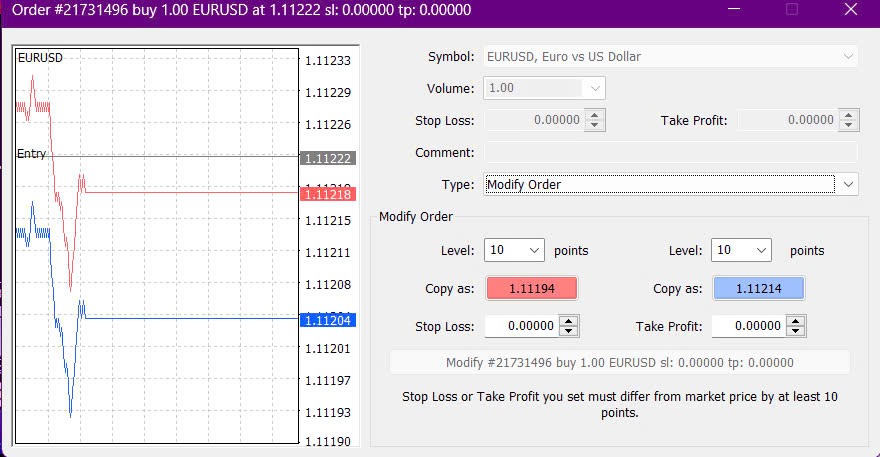

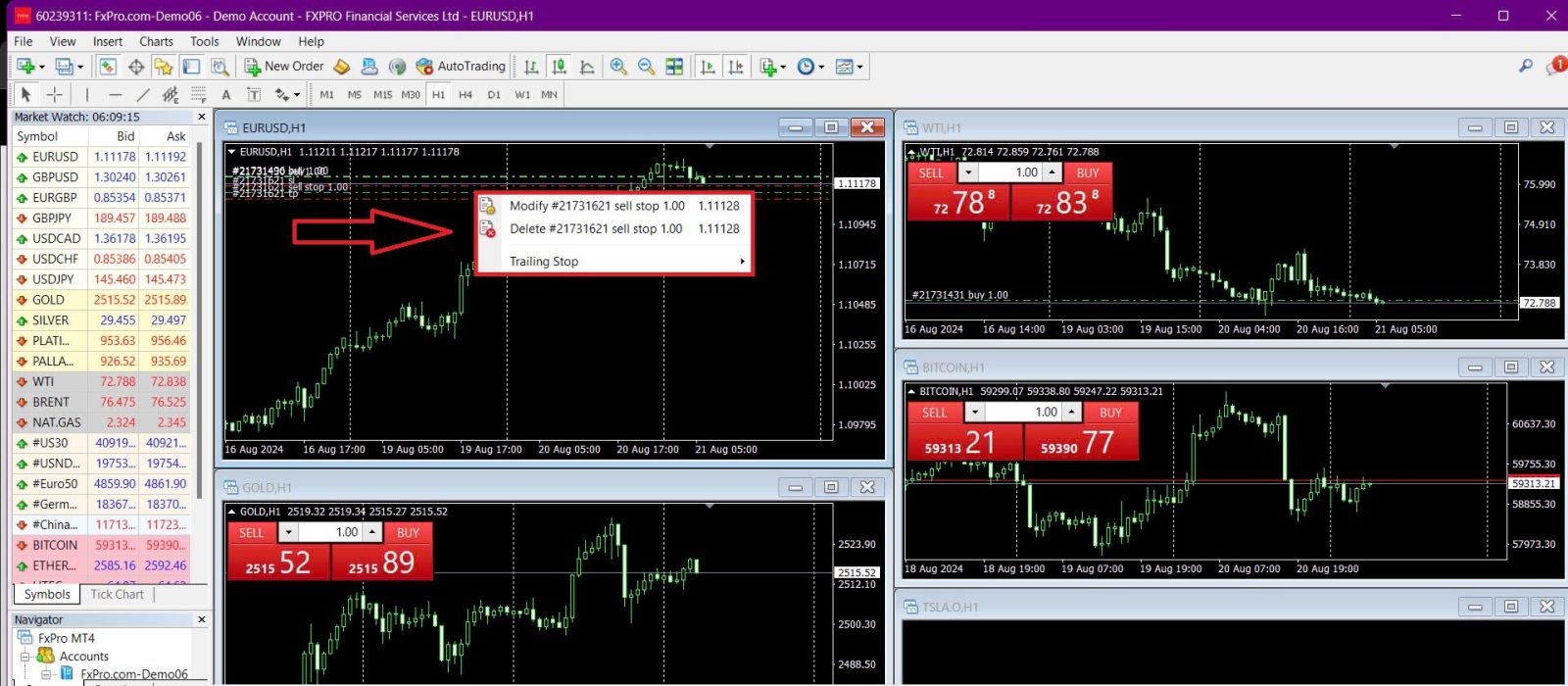

Please right-click on the chart, then click “Trading” and select “New Order” or double-click on the currency you want to place an order on in MT4, then the Order window will appear.

Symbol: Ensure that the currency symbol you wish to trade is displayed in the symbol box.

Volume: Decide the size of your contract. You can either click the arrow to choose the volume from the drop-down options or left-click in the volume box and type in the desired value. Remember that your contract size directly impacts your potential profit or loss.

Comment: This section is optional, but you can use it to add comments to identify your trades.

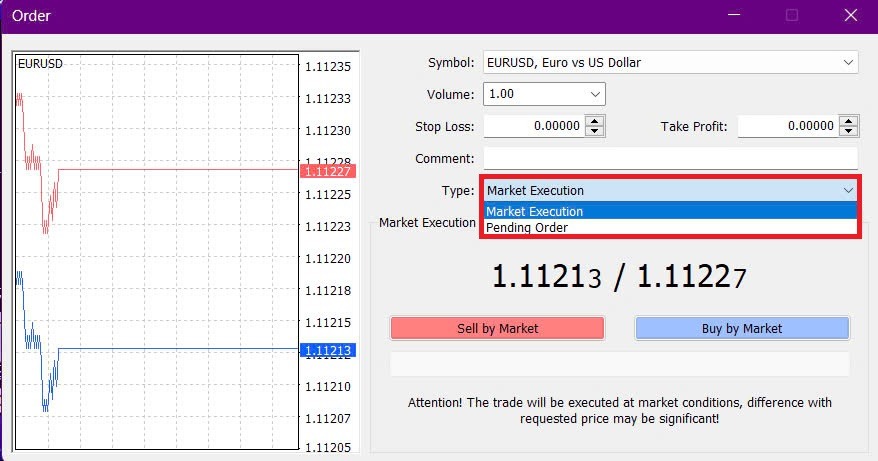

Type: The type is set to Market Execution by default:

-

Market Execution: Executes orders at the current market price.

-

Pending Order: Allows you to set a future price at which you intend to open your trade.

Finally, choose the order type to open — either a sell or a buy order:

-

Sell by Market: Opens at the bid price and closes at the ask price. This order type may bring profit if the price goes down.

-

Buy by Market: Opens at the asking price and closes at the bid price. This order type may bring profit if the price goes up.

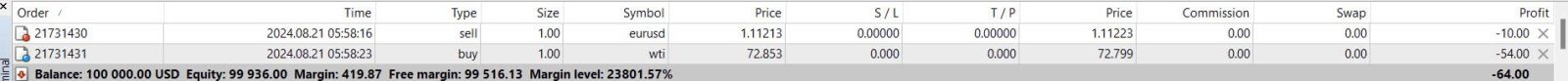

Once you click on either Buy or Sell, your order will be processed immediately. You can check the status of your order in the Trade Terminal.

How to place a Pending Order on FxPro MT4

How Many Pending Orders

Unlike instant execution orders, where trades are placed at the current market price, pending orders allow you to set orders that will be executed once the price reaches a specific level chosen by you. There are four types of pending orders, which can be grouped into two main categories:

-

Orders expecting to break a certain market level.

-

Orders are expected to bounce back from a certain market level.

Buy Stop

This order allows you to set a buy order above the current market price. For example, if the current market price is $20 and you set a Buy Stop at $22, a buy (or long) position will be opened once the market reaches $22.

Sell Stop

This order allows you to set a sell order below the current market price. For instance, if the current market price is $20 and you set a Sell Stop at $18, a sell (or short) position will be opened once the market reaches $18.

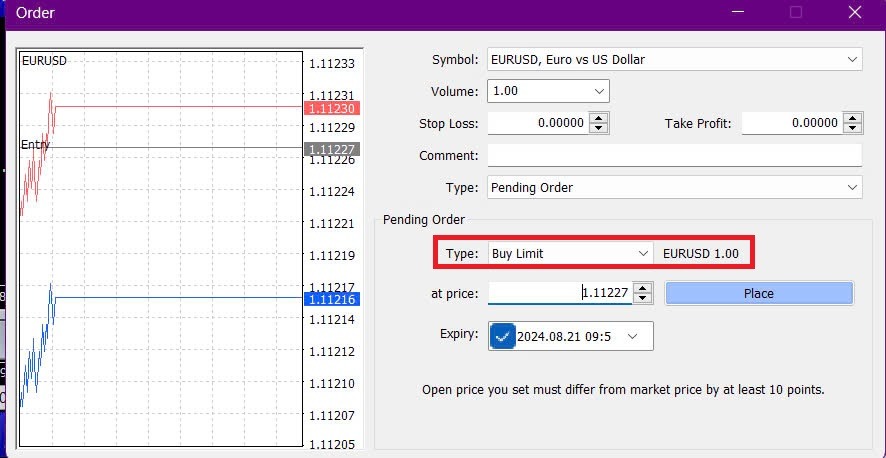

Buy Limit

This order is the opposite of a Buy Stop, allowing you to set a buy order below the current market price. For example, if the current market price is $20 and you set a Buy Limit at $18, a buy position will be opened once the market reaches the $18 level.

Sell Limit

This order allows you to set a sell order above the current market price. For instance, if the current market price is $20 and you set a Sell Limit at $22, a sell position will be opened once the market reaches the $22 level.

Opening Pending Orders

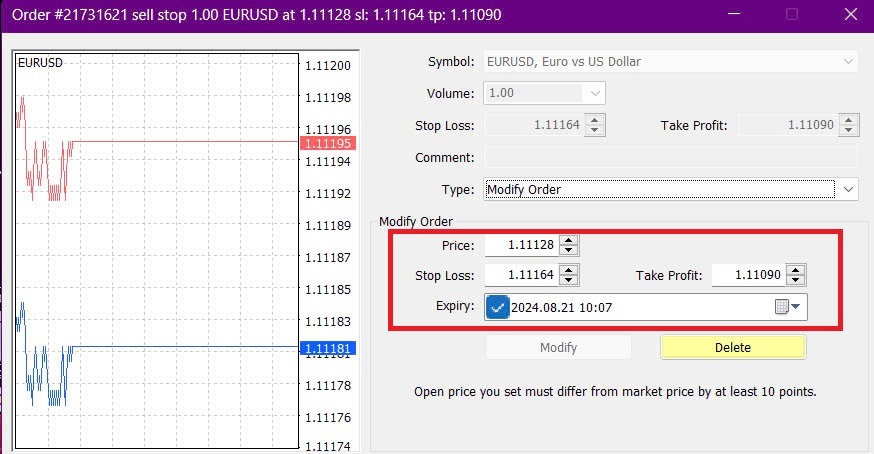

You can open a new pending order by double-clicking on the name of the market in the Market Watch module. This will open the new order window, where you can change the order type to "Pending Order".

Next, choose the market level at which the pending order will be activated and set the position size based on the volume.

If needed, you can also set an expiration date (Expiry). Once you have configured all these parameters, select the desired order type based on whether you want to go long or short and whether you’re using a stop or limit order. Finally, click the "Place" button to complete the process.

Pending orders are powerful features of MT4. They are especially useful when you can’t constantly monitor the market for your entry point or when the price of an instrument changes quickly, ensuring you don’t miss the opportunity.

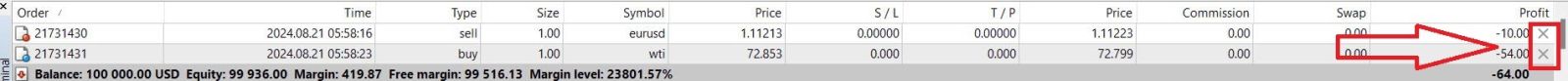

How to close Orders on FxPro MT4

To close an open position, click the "x" in the Trade tab of the Terminal window.

Alternatively, right-click the line order on the chart and select "Close".

If you want to close only a part of your position, right-click on the open order and select "Modify". In the Type field, choose instant execution and specify the portion of the position you want to close.

As you can see, opening and closing trades on MT4 is very intuitive and can be done with just one click.

Using Stop Loss, Take Profit, and Trailing Stop on FxPro MT4

One of the keys to long-term success in financial markets is effective risk management. Therefore, incorporating stop losses and taking profits into your trading strategy is essential.

Let’s explore how to use these features on the MT4 platform to help you limit risk and maximize your trading potential.

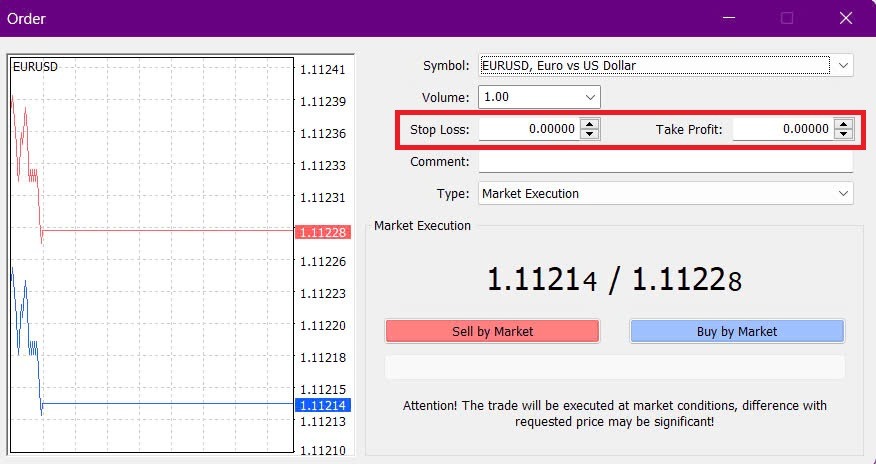

Setting Stop Loss and Take Profit

The simplest way to add a Stop Loss or Take Profit to your trade is by setting it up when placing new orders.

To set a Stop Loss or Take Profit when placing a new order, simply enter your desired price levels in the Stop Loss and Take Profit fields. The Stop Loss will automatically trigger if the market moves against your position, while the Take Profit will trigger when the price reaches your specified target. You can set the Stop Loss level below the current market price and the Take Profit level above it.

Remember, a Stop Loss (SL) or Take Profit (TP) is always linked to an open position or a pending order. You can adjust these levels after opening a trade while monitoring the market. Although they are not mandatory when opening a new position, adding them is highly recommended to protect your trades.

Adding Stop Loss and Take Profit Levels

The easiest way to add SL/TP levels to an already open position is by using the trade line on the chart. Simply drag and drop the trade line up or down to your desired level.

Once you’ve set the SL/TP levels, the SL/TP lines will appear on the chart, allowing you to easily modify them as needed.

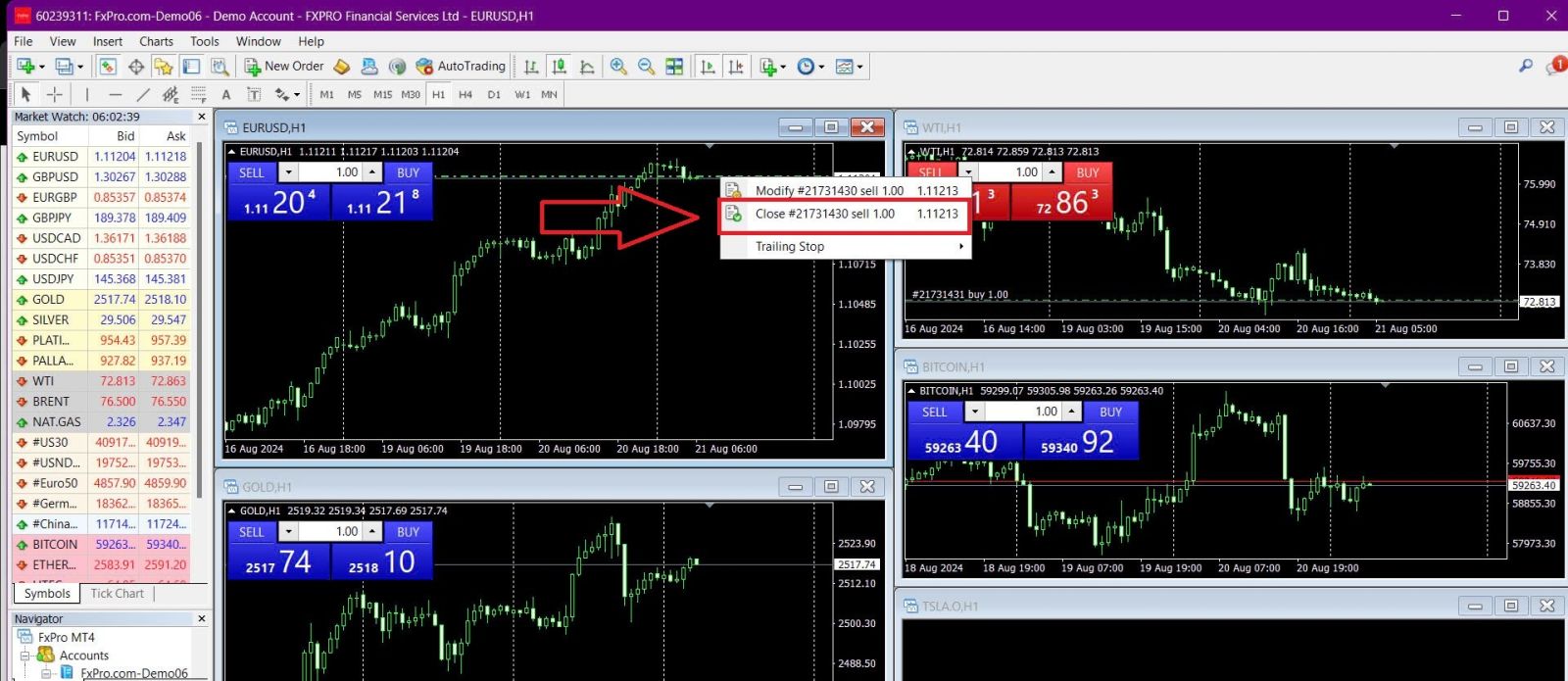

You can also adjust SL/TP levels from the bottom "Terminal" module. To do this, right-click on your open position or pending order and select "Modify" or "Delete" order.

The order modification window will appear, allowing you to enter or adjust SL/TP levels either by specifying the exact market price or by defining the points range from the current market price.

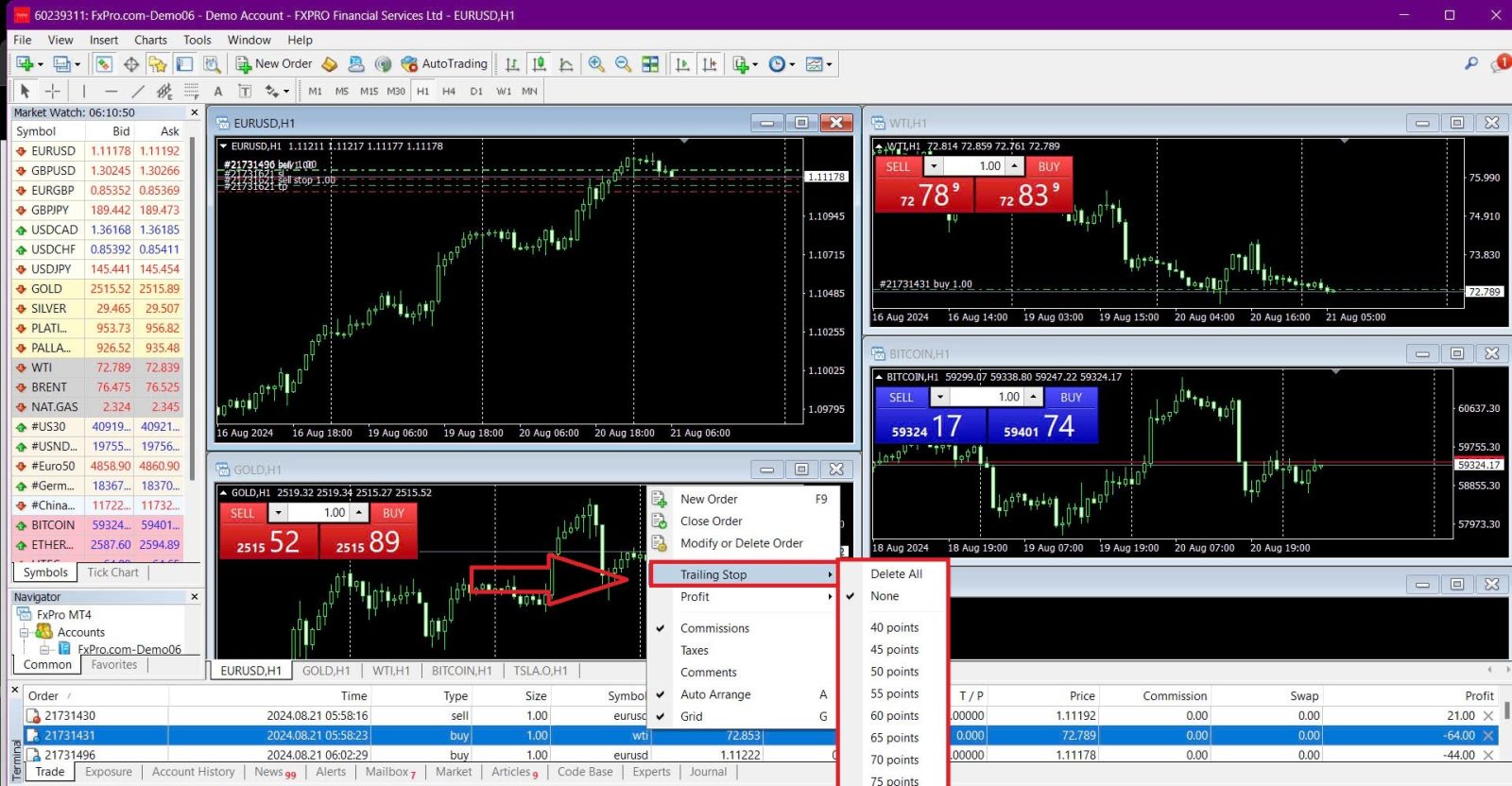

Trailing Stop

Stop Losses are designed to limit losses when the market moves against your position, but they can also help you lock in profits.

While it may seem counterintuitive, this concept is easy to understand. For example, if you’ve opened a long position and the market moves favorably, making your trade profitable, you can move your original Stop Loss (set below your open price) to your open price to break even, or even above the open price to secure a profit.

To automate this process, you can use a Trailing Stop. This tool is particularly useful for managing risk when price movements are rapid or when you can’t constantly monitor the market. As soon as your position becomes profitable, the Trailing Stop will automatically follow the price, maintaining the previously set distance.

Please remember that your trade must be profitable by a sufficient amount for the Trailing Stop to move above your open price and guarantee a profit.

Trailing Stops (TS) are linked to your open positions, but keep in mind that MT4 needs to be open for the Trailing Stop to be executed successfully.

To set a Trailing Stop, right-click the open position in the "Terminal" window and specify your desired pip value for the distance between the TP level and the current price in the Trailing Stop menu.

Your Trailing Stop is now active, meaning it will automatically adjust the stop loss level if the price moves in your favor.

You can easily disable the Trailing Stop by selecting "None" in the Trailing Stop menu. To quickly deactivate it for all open positions, choose "Delete All".

MT4 offers multiple ways to protect your positions quickly and efficiently.

While Stop Loss orders are effective for managing risk and keeping potential losses in check, they don’t offer 100% security.

Stop losses are free to use and help protect your account from adverse market moves, but they cannot guarantee execution at your desired level. In volatile markets, prices may gap beyond your stop level (jump from one price to the next without trading in between), which can result in a worse closing price than expected. This is known as price slippage.

Guaranteed Stop Losses, which ensure your position is closed at the requested Stop Loss level without the risk of slippage, are available for free with a basic account.

Frequently Asked Questions (FAQ)

Currency Pair, Cross Pairs, Base Currency, and Quote Currency

Currency pairs represent the exchange rate between two currencies in the foreign exchange market. For example, EURUSD, GBPJPY, and NZDCAD are currency pairs.

A currency pair that does not include USD is referred to as a cross pair.

In a currency pair, the first currency is known as the "base currency," while the second currency is called the "quote currency."

Bid Price and Ask Price

The Bid Price is the price at which a broker will buy the base currency of a pair from the client. Conversely, it is the price at which clients sell the base currency.

The Ask Price is the price at which a broker will sell the base currency of a pair to the client. Similarly, it is the price at which clients buy the base currency.

Buy orders are opened at the Ask Price and closed at the Bid Price.

Sell orders are opened at the Bid Price and closed at the Ask Price.

Spread

The spread is the difference between the Bid and Ask prices of a trading instrument and is the primary source of profit for market maker brokers.

The spread value is measured in pips.FxPro provides both dynamic and stable spreads across its accounts.

Lot and Contract Size

A lot is a standard unit size of a transaction. Generally, one standard lot equals 100,000 units of the base currency.

Contract size refers to the fixed amount of base currency in one lot. For most forex instruments, this is set at 100,000 units.

Pip, Point, Pip Size, and Pip Value

A point represents a price change in the 5th decimal place, while a pip signifies a price change in the 4th decimal place.

In other words, 1 pip equals 10 points.

For example, if the price moves from 1.11115 to 1.11135, the change is 2 pips or 20 points.

Pip size is a fixed number that indicates the position of the pip in the instrument’s price. For most currency pairs, such as EURUSD, where the price is displayed as 1.11115, the pip is at the 4th decimal place, so the pip size is 0.0001.

Pip Value represents the monetary gain or loss for a one-pip movement. It is calculated using the formula:

Pip Value = Number of Lots x Contract Size x Pip Size.

Our trader’s calculator can help you determine these values.

Leverage and Margin

Leverage is the ratio of equity to borrowed capital and directly affects the margin required for trading an instrument. FxPro provides up to 1

leverage on most trading instruments for both MT4 and MT5 accounts.

Margin is the amount of funds held in the account currency by a broker to keep an order open.

Higher leverage results in a lower margin requirement.

Balance, Equity, and Free Margin

Balance is the total financial result of all completed transactions and deposit/withdrawal operations in an account. It represents the amount of funds available before opening any orders or after closing all open orders.

The balance remains unchanged while orders are open.

When an order is opened, the balance combined with the profit or loss of the order equals Equity.

Equity = Balance +/- Profit/Loss

Part of the funds is held as a Margin when an order is open. The remaining funds are referred to as Free Margin.

Equity = Margin + Free Margin

Balance is the total financial result of all completed transactions and deposit/withdrawal operations in an account. It represents the amount of funds available before opening any orders or after closing all open orders.

The balance remains unchanged while orders are open.

When an order is opened, the balance combined with the profit or loss of the order equals Equity.

Equity = Balance +/- Profit/Loss

Part of the funds is held as a Margin when an order is open. The remaining funds are referred to as Free Margin.

Equity = Margin + Free Margin

Profit and Loss

Profit or Loss is determined by the difference between the closing and opening prices of an order.

Profit/Loss = Difference between closing and opening prices (in pips) x Pip Value

Buy orders profit when the price rises, whereas Sell orders profit when the price falls.

Conversely, Buy orders incur a loss when the price drops, while Sell orders lose when the price increases.

Margin Level, Margin Call, and Stop Out

The Margin Level represents the ratio of equity to margin, expressed as a percentage.

Margin Level = (Equity / Margin) x 100%

A Margin Call is a warning issued in the trading terminal, indicating that additional funds need to be deposited or positions need to be closed to prevent a stop-out. This alert is triggered when the Margin Level reaches the Margin Call threshold set by the broker.

A Stop Out occurs when the broker automatically closes positions once the Margin Level drops to the Stop Out level established for the account.

How to check your trading history

To access your trading history:

From Your Trading Terminal:

-

MT4 or MT5 Desktop Terminals: Navigate to the Account History tab. Note that MT4 archives history after a minimum of 35 days to reduce server load, but you can still access your trading history through log files.

-

MetaTrader Mobile Applications: Open the Journal tab to view the history of trades performed on your mobile device.

From Monthly/Daily Statements: FxPro sends account statements to your email daily and monthly (unless unsubscribed). These statements include your trading history.

Contacting Support: Reach out to the Support Team via email or chat. Provide your account number and secret word to request account history statements for your real accounts.

Is it possible to lose more money than I deposited?

FxPro offers Negative Balance Protection (NBP) for all clients, regardless of their categorization jurisdiction, thereby ensuring that you cannot lose more than your total deposits.

For more details please refer to our ‘Order Execution Policy’.

FxPro also provides a stop-out level, which will cause trades to be closed when a certain margin level % is reached. The stop-out level will depend on the account type and jurisdiction under which you are registered.

Conclusion: Simple and Risk-Free Trading with FxPro’s Demo Account

Registering and starting to trade with a demo account on FxPro is a straightforward process, giving you the perfect opportunity to familiarize yourself with the platform and the dynamics of forex trading. This risk-free environment ensures that you can build confidence and develop your trading strategies before transitioning to a live account. FxPro’s demo account is an invaluable tool for mastering the art of trading, offering you the foundation needed for future success.