FxPro Review

- Regulated by top-tier authorities

- Multiple trading platforms

- Competitive spreads and pricing

- Wide range of trading instruments

- No dealing desk intervention

- Excellent 24/5 customer support

- Rich educational resources

- Platforms: FxPro Trading Platform and App, MT4, MT5, and cTrader

What is FxPro?

FxPro is an online Forex broker and trading platform that started in 2006. Since then, it has greatly improved its services by focusing on a client-centered approach. According to our expert research, FxPro now serves retail and institutional clients in about 170 countries, with over 2 million trading accounts, making it one of the leading Forex brokerages.

What Type of Broker is FxPro?

We learned that FxPro is an NDD broker offering CFDs on 6 asset classes: Forex, Shares, Spot Indices, Futures, Spot Metals, and Spot Energies. The broker provides its clients with access to top-tier liquidity and advanced trade execution with no dealing desk intervention.

Where is FxPro Located?

We found out that FxPro is headquartered in UK, Cyprus Bahamas. These are separate legal entities belonging to the same group and each jurisdiction is regulated by the relevant regulatory body in that country. The broker also has a representative office in the UAE.

FxPro Pros and Cons

FxPro has a long history of operation and is a heavily regulated Broker with an excellent reputation. The account opening is easy, and there is a great range of trading tools and user-friendly software, platform range is comprehensive too, good thing trades can choose between fee models either with spread or commission basis. FxPro education and research are high quality and beginners are very welcome with great resources provided. Overall FxPro is one of the leading Brokerages with constant developments and strives, so considering all the facts it is indeed attractive Broker to select or choose from.

For the Cons, proposals vary according to the entity, and deposit methods are not available in some regions, so is good to verify conditions fully.

| Advantages | Disadvantages |

|---|---|

| Heavily regulated broker with a strong establishment | Conditions vary based on the entity |

| Wide range of trading platforms and competitive trading conditions | |

| Global expands across Europe, Asia, and America | |

| Good quality educational materials, and excellent research | |

| Quality customer support with live chat and fast response |

FxPro Review Summary in 10 Points

| 🏢 Headquarters | UK |

| 🗺️ Regulation | FCA, CySEC, SCB, FSCA, FSCM |

| 🖥 Platforms | MT4, MT5, cTrader, FxPro Platform |

| 📉 Instruments | Forex and CFDs on 6 asset classes, with over 2100 trading instruments |

| 💰 EUR/USD Spread | 0.9 pips |

| 🎮 Demo Account | Available |

| 💰 Base currencies | EUR, USD, GBP, AUD, CHF, JPY, PLN and ZAR |

| 💳 Minimum deposit | $100 |

| 📚 Education | Profesisonal education and free reserch tools |

| ☎ Customer Support | 24/7 |

Overall FxPro Ranking

Based on our Expert findings, FxPro is considered a good broker with safe and very favorable trading conditions. The broker offers a range of trading services designed for both beginner traders and professionals with low initial deposit amounts. As one of the good advantages, FxPro covers almost the globe, so traders from various countries can sign in, also with the lowest spreads.

- FxPro Overall Ranking is 9.2 out of 10 based on our testing and compared to over 500 brokers, see Our Ranking below compared to other industry Leading Brokers.

| Ranking | FxPro | AvaTrade | Pepperstone |

|---|---|---|---|

| Our Ranking | ⭐⭐⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Advantages | Deep Liquidity | Trading Conditions | Trading Platforms |

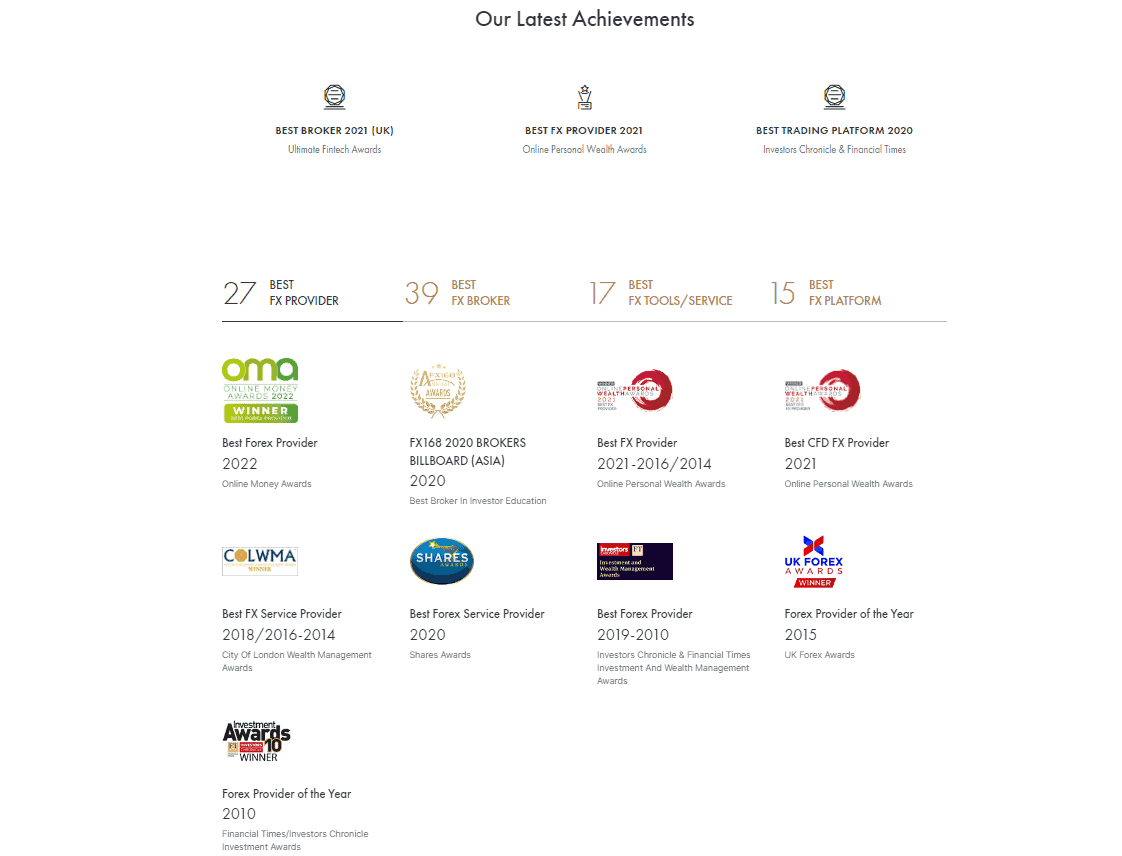

Awards

Tons of customers around the world and general reviews bring the understanding that FxPro achieved sustainable trust in the industry and gained the highest ranks. But in addition to that, international rewards from the largest financial institutions and organizations brought a conclusion that the manner FxPro operates its NDD execution and operation itself deserves recognition too.

Based on our findings, we learned that starting from 2006 FxPro has received constant recognition in the industry, winning over 95+ international awards to date for the quality of its services.

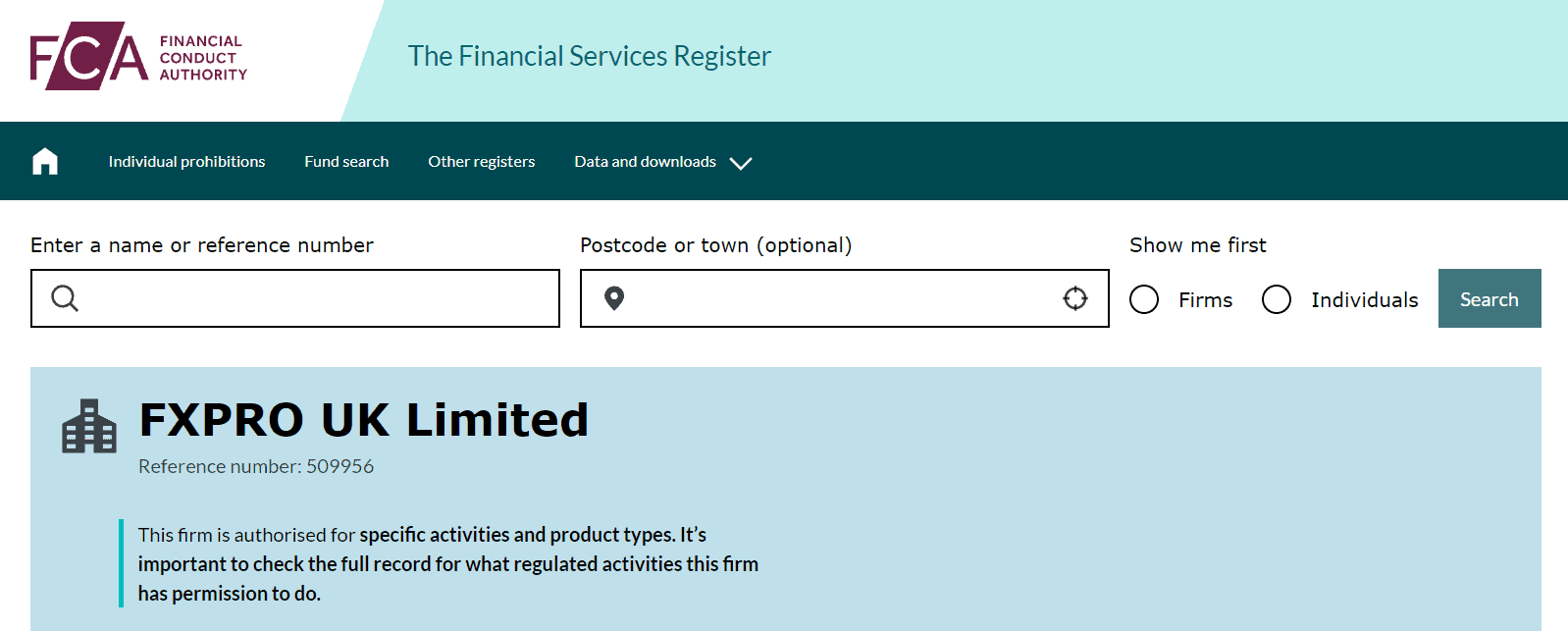

Is FxPro Safe or Scam?

No, FxPro is not a scam. Based on our Expert research, we found that FxPro is a safe broker to trade with. It is regulated and licensed by several top-tier financial authorities including respected UK FCA and CySEC. Therefore, it is secure and low-risk to trade FX and CFD with FxPro.

Is FxPro legit?

Yes, FxPro is a legit and regulated broker in various jurisdictions.

- It is regulated and authorized not only by one regulator but by several, which gives it extra layers of security and always for traders’ better.

- We learned that as a licensed broker, FxPro is subject to strict European laws, providing its financial services guaranteed by legal regulatory agencies.

See our conclusion on FxPro Reliability:

- Our Ranked FxPro Trust Score is 9.2 out of 10 for good reputation and service over the years, also reliable top-tier licenses, and serving regulated entities in each region it operates. The only point is that regulatory standards and protection vary based on the entity.

| FxPro Strong Points | FxPro Weak Points |

|---|---|

| Multiply regulated broker with a strong establishment | Regulatory standards and protection vary based on the entity Regulated by top-tier authorities |

| Regulated by top-tier authorities | |

| Global expands over 173 countries | |

| Negative balance protection | |

| Compensation Scheme |

How Are You Protected?

The regulated status of the broker, first of all, ensures its legit status, a regular check on the performance from the respected authority that ensures the client’s deposit by the set of protective measures.

Based on our research, we found that client funds are stored in segregated accounts of European investment-grade banks, while the trader is a participant in the compensation of investors in case of FxPro insolvency, as well as trade with negative balance protection.

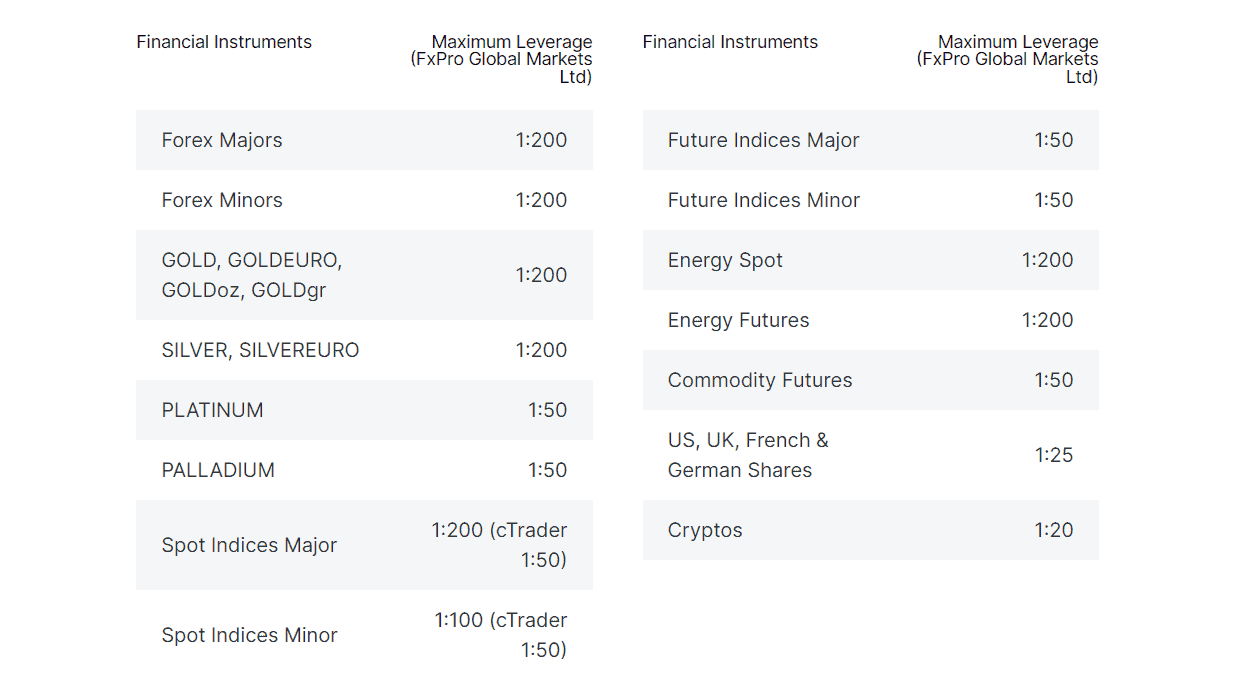

Leverage

Leverage specification at FxPro offers a dynamic forex leverage model with various levels as the regulatory requirements of a particular entity set and obliged broker to follow. Majority of traders will be eligible for lower trading leverage, only international branches still offer high leverage which is quite risky too. Based on our Expert research, we found that the maximum leverage offered by FxPro may differ depending on jurisdiction and the instrument/platform the clients are trading with:

- The maximum leverage level for European clients is up to 1:30

- The maximum leverage level for International traders is up to 1:200

Account Types

We found that FxPro offers two main accounts, Standard where all fees built into a spread basis and Raw Account with a commission basis, also additional Elite account with all the same features and a full package of advantages with difference that Elite account is eligible for traders with over $30k allowing to get trading rebates. Besides Micro Accounts and Swap-free accounts are available feature so can be both traded on any account offering too. A Demo account for practices remains available with a Live account through an easy switch between Live and Demo account right from the platform.

| Pros | Cons |

|---|---|

| Fast account opening | Account types and proposals may vary according to jurisdiction |

| Low minimum deposit | |

| Access to a wide range of financial instruments | |

| Islamic and Micro accounts are available | |

| Account base currencies EUR, USD, GBP, AUD, CHF, JPY, PLN, and ZAR |

How to Trade in FxPro?

Starting to trade with FxPro, you will first need to open an account and deposit funds. The process is simple and can be done entirely online. Once your account has been approved, you can then make a deposit using one of the many methods available. Based on our research we found out that FxPro offers user-friendly platforms with good trading tools and resources you need to trade successfully.

How to Open FxPro Live Account?

Opening an account with FxPro is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

- Click on the “Register” icon on the FxPro homepage

- You will be asked to upload your ID documents during the process, or you can upload them later via FxPro Direct

- Once registered, you can proceed to fund your account and start trading on any one of our platforms.

Trading Instruments

Based on our research, we found that at the development stage FxPro started as a Forex broker and then spread further into providing CFDs on 6 asset classes, with over 2100 trading instruments. Now broker still continues its development by adding on more instruments hence influencing the company’s growth too. The FxPro Cryptocurrencies offer speculation on CFDs with the most popular cryptos like Bitcoin Ethereum etc, which is a great advantage too.

- FxPro Markets Range Score is 8.5 out of 10 for wide trading instrument selection among Forex, Futures, Indices, Cryptos, and more.

FxPro Fees

We found that FxPro trading fees are built either into the FxPro tight spread from 1.2 pips, which is a difference between the bid and ask price or FxPro charges commission if you choose Raw account, also overnight or swap/rollover fees should be counted as fees as well. The swap is charged automatically at 21:59 (UK time) to the client account and is converted into the currency that the account is denominated in.

- FxPro Fees are ranked average with an overall rating of 8.5 out of 10 based on our testing and compared to over 500 other brokers. Fees might be different based on entity offering, see our findings of fees and pricing in the table below, however, FxPro overall fees are considered good.

| Fees | FxPro Fees | Pepperstone Fees | XM Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | No | Yes |

| Fee ranking | Low, Average | Low | Average |

Spreads

Based on our Expert findings, we learned that FxPro offers both variable and fixed spreads depending on the account type the trader chooses.

On Standard account available across all platforms MT4/MT5 spreads are with marked-up spreads from 1.2 pips representing the trading fees and have zero commission, see our test spread table below. On the MT4 Raw+ account, FxPro offers spreads without markup on FX Metals, with a commission of $3.50 per lot. On the cTrader platform account, spreads on FX and metals are lower, with a commission of $35 per $1 million USD traded, so the choice is on trader which fee basis to choose.

- FxPro Spreads are ranked low with an overall rating of 7.8 out of 10 based on our testing comparison to other brokers. We found Forex spread lower or at the same range as the industry average, and spreads for other instruments are quite attractive too.

| Asset/ Pair | FxPro Spread | Pepperstone Spread | XM Spread |

|---|---|---|---|

| EUR USD Spread | 1.2 pips | 0.77 pips | 1.6 pips |

| Crude Oil WTI Spread | 4 | 2.3 pips | 5 pips |

| Gold Spread | 25 | 0.13 | 35 |

| BTC USD Spread | 40 | 31.39 | 60 |

Deposits and Withdrawals

The number of payment methods to fund the trading account will allow you to transfer funds quickly by the use of Bank Wire transfers, Credit/Debit cards, PayPal, Neteller, Skrill, and more.

There is a multitude of ways to fund the trading account as well as to enjoy a $0 fee for money transfers, yet be sure to verify conditions according to the FxPro entity you will trade through.

- FxPro Funding Methods we ranked good with an overall rating of 8 out of 10. The minimum deposit is among average in the industry, yet fees are either none or very small also allowing to benefit from various account-based currencies, yet deposit options vary on each entity.

Here are some good and negative points for FxPro funding methods found:

| FxPro Advantage | FxPro Disadvantage |

|---|---|

| $100 is a first deposit amount | Methods and fees vary in each entity |

| No internal fees for deposits and withdrawals | |

| Fast digital deposits, including Skrill, Neteller, PayPal, and Credit Cards | |

| Multiple Account Base Currencies | |

| Withdrawal requests confirmed within 1 working day |

Deposit Options

In terms of funding methods, FxPro offers numerous payment methods which are a very good plus, yet check according to its regulation whether the method is available or not.

- Credit/Debit cards

- Bank Wire

- PayPal

- Skrill

- Neteller

FxPro Minimum Deposit

FxPro Minimum Deposit is set to $100, however, the broker recommends depositing at least $1,000 to enjoy the full features of the trading itself.

FxPro minimum deposit vs other brokers

| FxPro | Most Other Brokers | |

| Minimum Deposit | $100 | $500 |

FxPro Withdrawals

FxPro does not charge any fees or commissions on deposits/withdrawals, however, you may be subject to fees from banks involved in the case of bank transfers. We learned that the broker typically processes withdrawal requests within 1 working day.

How Withdraw Money from FxPro Step by Step:

- Login to your account

- Select Withdraw Funds’ in the menu tab

- Enter the withdrawn amount

- Choose the withdrawal method

- Complete the electronic request with necessary requirements

- Confirm withdrawal information and Submit

- Check the current status of withdrawal through your Dashboard

Trading Platforms

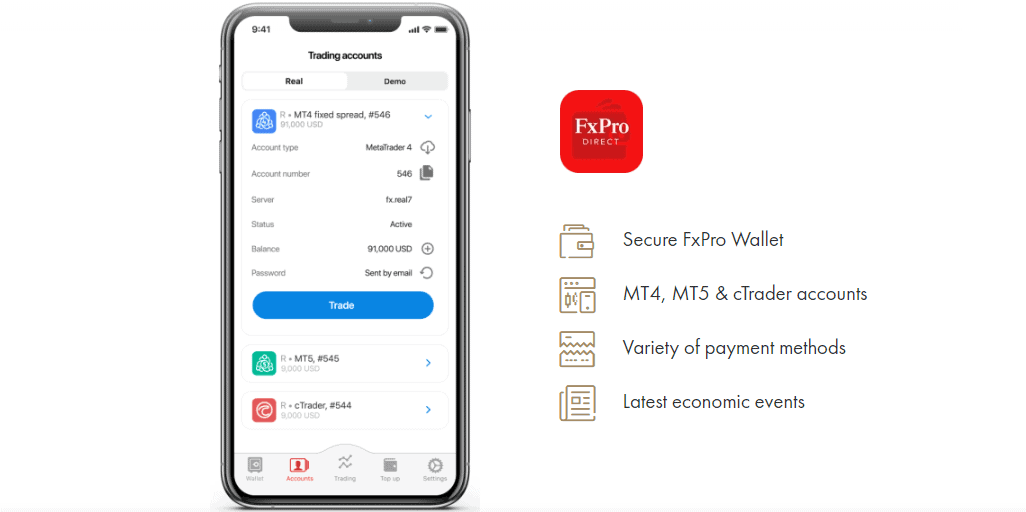

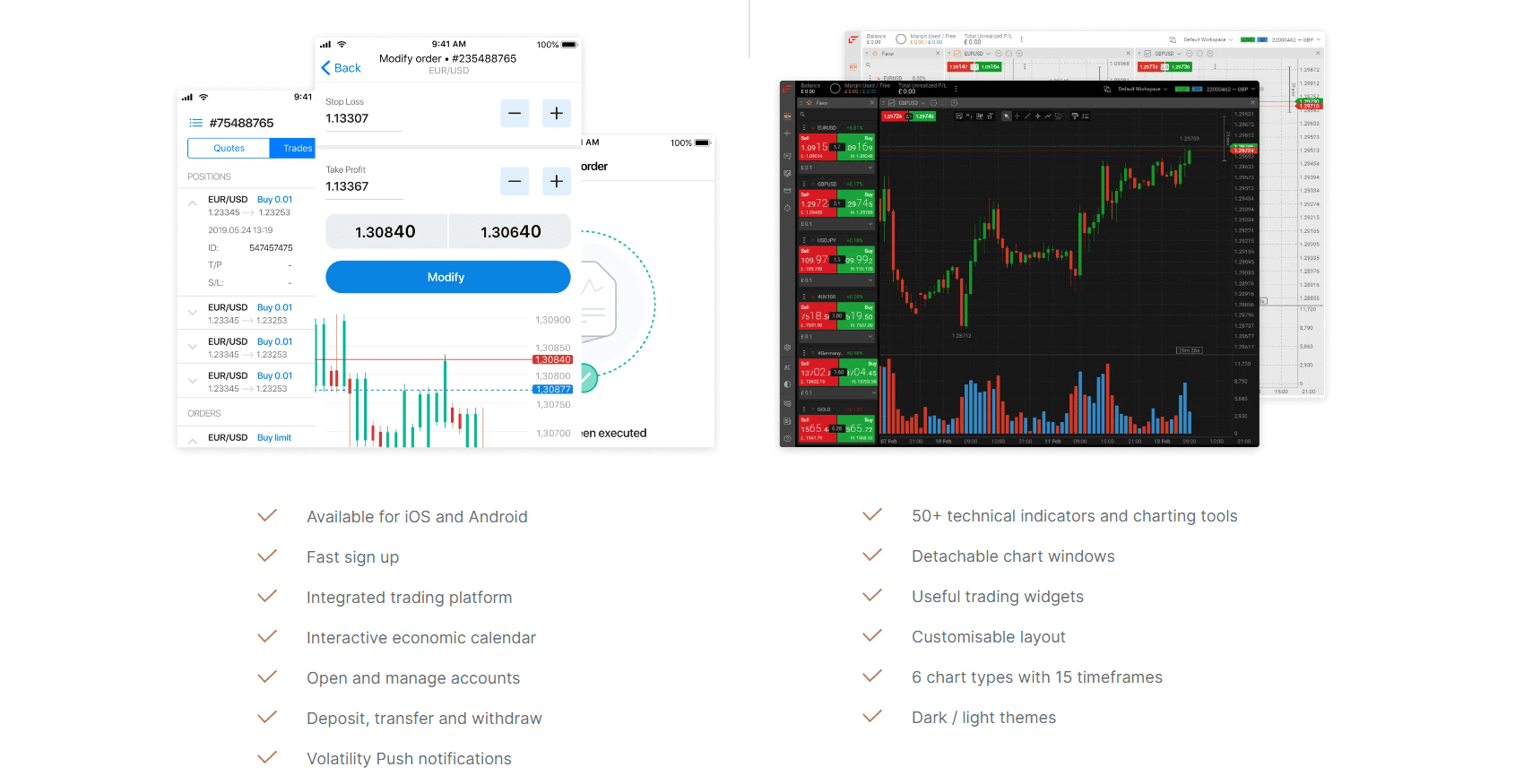

Based on our Expert research, we found that FxPro provides a range of top-grade desktop, web, and mobile trading platforms including the FxPro Trading Platform, MT4, MT5, and cTrader.

- FxPro Platform is ranked Excellent with an overall rating of 9 out of 10 compared to over 500 other brokers. We mark it as excellent being one of the best proposals we saw in the industry, and a great range including MT4, MT5, and cTrader suitable for professional trading. Also, all are provided with good research and excellent tools.

Trading Platform Comparison to Other Brokers:

| Platforms | FxPro Platforms | Pepperstone Platforms | XM Platforms |

|---|---|---|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | Yes | Yes | No |

| Own Platform | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Web Trading Platform

We found that the online web trading platform allows convenient access to traders’ FxPro EDGE Accounts directly from their browsers with a highly customizable interface and advanced trading widgets.

For mobile, the FxPro app provides an all-in-one solution, allowing clients to manage their accounts, manage funds, and trade from the integrated platform.

Desktop Platform

The desktop platform is of course available to download and suitable for any device, while with the desktop version the trader will get the full package and sophistication each platform may offer.

- There are vast opportunities, tools, measures, and add-ons available with automatic trading, no restrictions on scalping, or the option to use proven managers and pre-tested trading strategies under all major risk management rules.

- Moreover, all traders are offered to use a VIP package of services that includes a number of advantages: free VPS server, no deposit fees, SMS notification of the margin, free news reports, and many more.

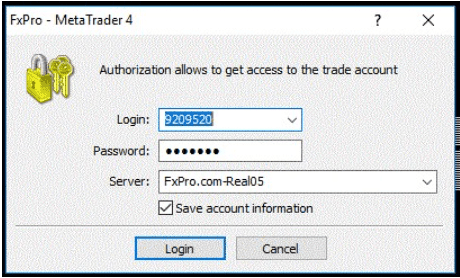

How to Use FxPro MT4?

To open FxPro MT4 account, you need to:

- Download the software from the FxPro Download Centre

- Log in to your terminal from the menu at the top left of the screen

- Click “File”, then “Log in to trade account”, and a new box asking for your login credentials, password, and the server your account has been assigned to will appear

Your login details are sent to you via email once your account has been created. If you have forgotten your MT4 live account password, you can reset this via FxPro Direct.

Customer Support

We learned that FxPro offers dedicated 24/7 multilingual customer service, and provides relevant answers. Livechat, email, and phone communication are also available to help traders with whatever they need.

- Customer Support in FxPro is ranked Excellent with an overall rating of 9.5 out of 10 based on our testing. We got some of the fastest and most knowledgeable responses compared to other brokers, also quite easy to reach during both working days and weekends.

See our find and ranking on Customer Service Quality:

| Pros | Cons |

|---|---|

| Quick responses and relevant answers | None |

| 24/7 customer support | |

| Supporting numerous languages | |

| Availability of Live Chat |

FxPro Education

Based on our research, we found that FxPro provides a rich collection of educational materials including Free Forex trading online courses for both beginners and advanced traders, webinars, fundamental analysis, technical analysis, video tutorials, and more.

- FxPro Education ranked with an overall rating of 8.5 out of 10 based on our research. The broker provides very good quality educational materials, and excellent research also cooperates with market-leading providers of data.

FxPro Review Conclusion

To conclude our review of FxPro, we consider it a safe broker that offers reliable trading solutions. FxPro has earned a strong and respected reputation due to its diverse trading strategies and its approach to dealing with markets and traders.

We also found that FxPro’s flexibility in platforms, currency pairs, and the range of solutions it offers is a significant advantage. The broker provides competitive costs and excellent educational materials that cater to traders of all experience levels.

Based on Our findings and Financial Expert Opinions FxPro is Good for:

- Beginners

- Advanced traders

- Traders who prefer MT4/MT5 and cTrader platforms

- Currency and CFD trading

- Variety of trading strategies

- Algorithmic or API traders

- Good customer support

- Excellent educational materials